A Limited Liability Company is a structure that provides limited liability protection to its owner. For first-time homebuyers, buying a house with an LLC in the long run results in a loss.

The first-time homebuyer has to pay a high maintenance fee and 100% tax on the profit gained after the sale. On the other hand, it could be a good deal for investors or real estate entrepreneurs.

Buying a House With an LLC

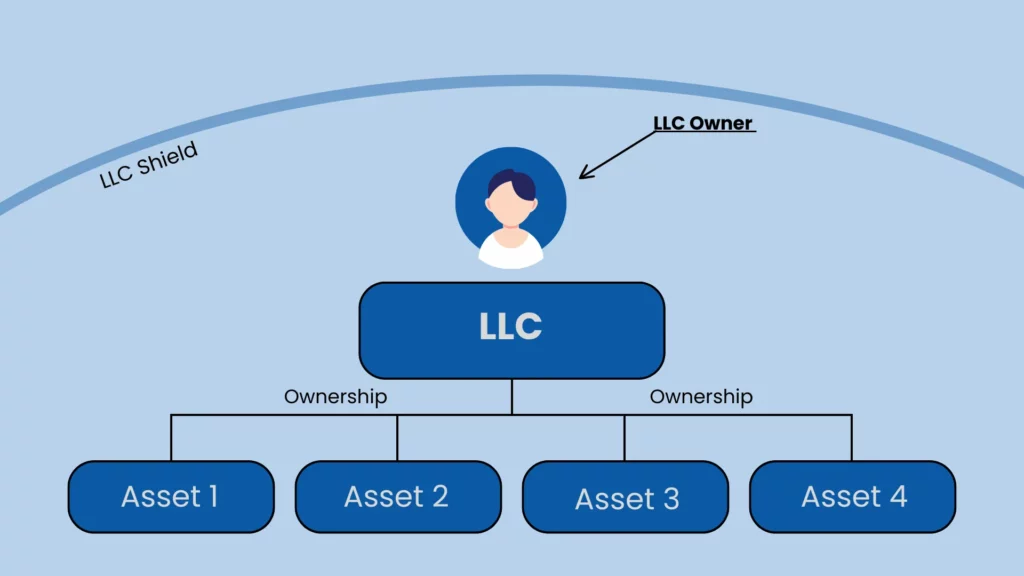

A Limited Liability Company (LLC) is a corporate structure that protects the owner from the responsibility of the company’s debts and liabilities. Because of this, banks don’t show much trust in homebuyers with LLCs.

To tackle such a situation, homebuyers get the mortgage first in their name and later transfer the property to the LLC. However, the homebuyer is still liable for the funds, but the LLC will hold over the property.

If the LLC owner has multiple properties under the LLC and, for instance, the owner’s personal assets are at risk, the assets under the LLC will be safeguarded.

Pros and Cons of Buying a House With an LLC

Here are the pros and cons of buying a house with an LLC:

Pros

- Tax Benefits: LLCs pass-through tax structure removes the possibility of double taxation. Which makes buyers pay for their allocated share, and LLCs pay taxes on the profits.

- Asset Protection: It is one of the frontline features of an LLC. With an LLC, your house will be secured if you have a business that involves the risk of a lawsuit.

- Privacy: If you buy a house with an LLC, public documents show the house is bought under the LLC’s name, i.e., the corporation. LLC helps to maintain privacy and keeps your identity away from others.

- Ownership Flexibility: Most states allow single-member LLCs, but you can have multiple-owner LLCs. The list of multiple owners includes real estate entrepreneurs, foreign investors, corporations, and more.

Cons

- Lose the Capital Tax Exemption: If you have bought a primary house without an LLC, you don’t have to pay capital gains tax on the first $250,000 profit ($500,000 if married) while selling it. Whereas in the LLC case, you have to pay capital gains tax on 100% of the profit.

- Maintenance Costs: As a first-time home buyer, setting up and maintaining an LLC could cost you extra. On average, LLC owners pay $1,000 in fees annually.

- Limited Finance Options: Because of the LLC’s protection feature, you cannot apply for multiple loans like Fannie Mae, Freddie Mac, FHA loans, and more.

Who Is Fit to Consider Using an LLC to Buy a House?

LLCs are good for those who are more experienced and planning to make a career in real estate. For first-time homebuyers, you could lose more money in fees and other expenses. In addition, you can face more after-sales issues linked to tax exemptions.

Financing an LLC Purchase

LLC reflects a risky investment for lenders, so you may face difficulty financing it. Generally, the LLC has to pay a 25% downpayment, but it does have some loan programs that ask for a lower down payment.

Here are some of the LLC financing options:

- Traditional Mortgages: The LLC owner may have to personally guarantee the loan. If they do so, they may get the loan at lower interest rates.

- LLC Loans: There are specially designed LLC loans, but they may have different terms and conditions from those of other lenders.

- Asset-Based Loans: It is useful for those who are in the real estate investment business. For asset-based loans, you have to use the property as collateral.

Bottom Line

LLC has many advantages, but for the first-time buyer, it has more cons compared to pros. If you plan to make a career in real estate, an LLC can be a viable option for risk-free transactions and securing your property.

If you still want to buy a house but are not getting the best deal, Houzeo could be a great platform for it. They have a wide range of houses listed on their domain, from which you can find the house that fits your budget.

» Need More Clarity? Read these exclusive Houzeo reviews and learn why the platform is the best in America’s competitive housing market.

Frequently Asked Question

Can I live in a house owned by my LLC?

Yes, you can live in a house owned by your LLC. But it will affect the property’s liability protection.

Can an LLC get an FHA loan?

No, you can’t get a FHA loan with an LLC. FHA loans are basically for the individual borrower, whereas LLCs exist as corporations.

What are the requirements to buy a house under an LLC?

You have to establish the LLC and later view the financial options for it. In addition, you have to prepare a purchase agreement to proceed with the transaction.

.webp)