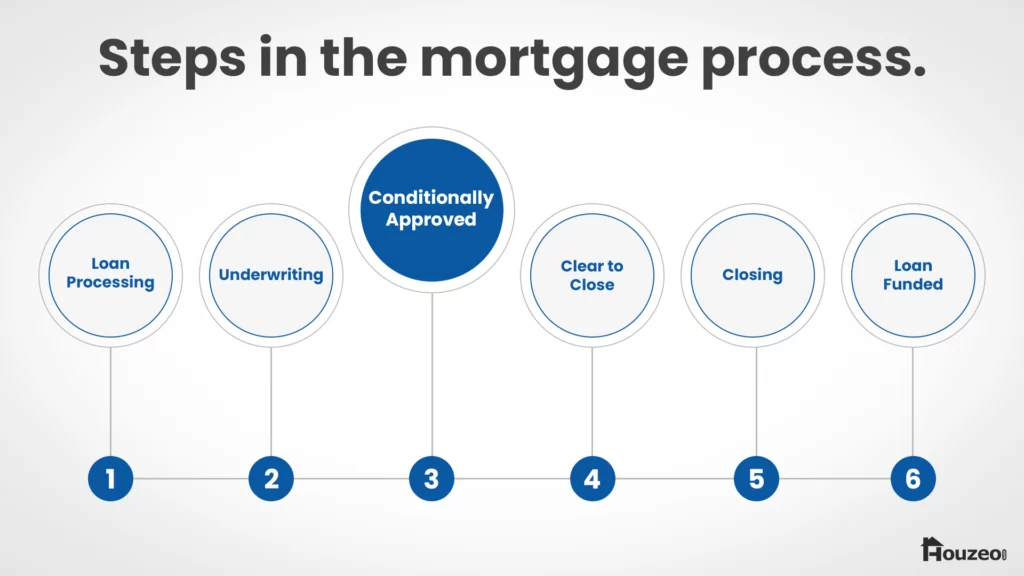

It takes 5-7 weeks to buy a house with a mortgage. Conditional approval is the midpoint of your mortgage process. Once you get it, you are just 1-3 weeks away from the closing.

Conditional approval is a step in the mortgage application process where the lender asks for additional financial documents from the borrower. Getting conditional approval indicates that the borrower has satisfied the lender’s initial requirements.

Benefits of having a conditional approval

- Having a conditional approval means higher chances of getting the loan. It indicates that your initial paperwork has been approved.

- With a conditional approval, you are in a better position to negotiate with the seller. They prefer buyers who are close in getting the funds to buy the house.

- You can have a quicker closing as underwriting process gets completed before conditional approval.

- Conditional approval will give you a clear idea of the amount that the lender is willing to give. This will help you to focus only on searching for homes that you can afford.

Why Is Conditional Approval Required?

Conditional approval is like a ‘green signal’ which indicates you are on the right path in the mortgage application process. It helps the homebuyers in the following ways:

- Sets Loan Terms: At the conditional approval stage, the lender will specify the loan amount, interest rate, and mortgage term. This allows you to understand your mortgage plan better.

- Reduces Risks for Lenders: It allows the lenders to understand the borrower’s repayment ability.

- Provides Clarity on Issues: The conditional approval process allows you to identify any issues with your mortgage application. It provides you the chance to align all your documents and paperwork.

- Helps with Better Deals: Once you have your conditional approval letter from the lender, you can make multiple offers and negotiate with sellers for a better deal.

- Helps with Budget Planning: You can set a realistic budget for your home purchase journey. Moreover, you will get a clear idea of how much you can borrow and at what interest rate.

What Are the Requirements for Conditional Approval?

Here is a list of the common approval conditions that the lender asks for:

- Income statements.

- Homeowners Insurance verification.

- Employment proof.

- Tax returns.

- Gift letter– if the buyer uses gift money to pay the downpayment of the loan.

- Clarification letter- if the buyer has made any recent big cash withdrawals.

Types of Mortgage Approval

There are three types of mortgage approval that every home buyer should know:

- Pre-qualification: During pre-qualification, you provide basic details to the lender, such as your income, employment history, and credit score. The lender will evaluate your eligibility for the loan. Furthermore, you get an estimate of the loan amount you can borrow.

- Pre-approval: It is a more detailed step in the mortgage process. During pre-approval, the lender will cross-verify your documents.

- Pre-underwritten Approval: At this stage, a loan underwriter will review your application. You must provide extensive financial documents. Furthermore, once you pass the pre-underwritten approval, the lender will give you a more solid commitment.

What Affects Conditional Approval?

Several factors affect your ability to secure a mortgage. The condition of approval will depend on the following factors:

- Credit Score: You should have a minimum credit score of 620 for a conventional mortgage. The higher the credit score, the better your chances of getting a mortgage approval.

- Financial History: Lenders prefer borrowers with stable incomes and reliable jobs. You will have to prove your financial credibility during the approval process.

- Debt-to-Income Ratio: Lenders require the DTI ratio to calculate your monthly debt payments to your gross monthly income. A lower ratio indicates better financial stability.

- Property Appraisal: Some lenders may require home buyers to conduct a professional home appraisal during the approval process. Moreover, this helps the lender determine the property value.

- Down Payment: The amount of money you put towards the down payment will affect the conditional mortgage approval. A larger down payment is preferable to the lender as it lowers their repayment risk.

It’s important to note that each lender may have specific conditions to be met. However, you can consider the above points as common factors.

When Is Conditional Approval Denied?

The lender can reject your mortgage application during the conditional approval phase. Here are a few reasons for rejection:

- Poor Credit History: Low credit scores and payment defaults can negatively affect your mortgage application process.

- High Debt-to-Income Ratio: If your debt exceeds your income, the lender can deny your application.

- No Job Security: Frequent job changes or recent unemployment can reduce your chances of getting pre-approval.

- Appraisal Issues: If the appraisal value does not match the estimated purchase price, the lender can reject the mortgage pre-approval.

Even if your conditional approval is denied, it is not the end of your home ownership dream. Work with your lender to understand why your application was rejected and take steps to improve your chances.

What Happens After Conditional Approval?

After conditional approval, you must submit the requested documents and wait till the underwriter verifies them. If you meet all conditions, you will get a formal approval. After that, you will move to the ‘clear to close’ stage.

What Does the Clear to Close Stage Mean?

Clear to close means that you have successfully fulfilled all conditions of the mortgage process. At this stage, the lender completes the inspection of your documents and creditworthiness.

Furthermore, the lender will send a closing disclosure 3 days before the closing date. This gives you enough time to go through the mortgage terms before signing.

Bottom Line

Getting conditional approval is a positive sign for home buyers. With conditional approval, a buyer can strike a deal faster. Furthermore, it gives them the confidence to negotiate with the seller.

As a new home buyer, you must be aware of all the steps involved in the mortgage process. It will help you to be ready in advance to face the tricky real estate market. To start your home search, browse properties online.

Find Your New Home With Houzeo

With thousands of property listings, Houzeo.com is one of the biggest property listing sites in the US. Find condos, townhouses, co-ops, and other types of homes for sale on Houzeo.

» Need More Clarity? Read these exclusive Houzeo reviews and learn why the platform is the best in America’s competitive housing market.

Frequently Asked Questions

Is conditional approval a good sign?

Yes, getting a conditional approval means your initial paper-work for the loan qualification is approved.

What are the steps after conditional approval?

After you are granted conditional approval, proceed to providing the requested documents. The lender will review your paperwork and resume the closing process.

How long does it take to close after conditional approval?

Once you get your conditional approval, you are just 1-3 weeksaway from the closing.

.webp)