Your credit score is an inevitable element when you ask for credit, be it for a home mortgage, or credit cards. A credit score is determined by evaluating your payment history, the amount of debt you have, and the length of your credit history.

Let’s find out the factors associated with a good credit score.

A GOOD CREDIT SCORE TO BUY A HOUSE

- A credit score range is a three-digit number that falls between 300-850. It is calculated by analyzing information in your credit report, which includes your debt, payment track record and credit history.

- FICO and VantageScore are two scoring models that lenders use to assess your financial stability.

- You would require a good credit score to purchase a house. It varies from 500 to 700 based on the type of mortgage loan you apply for and your lender.

What Is a Credit Score?

A credit score refers to a numerical representation of an individual’s creditworthiness. It measures how likely the borrowers are to repay the money or fulfill their financial obligations.

A borrower’s higher credit score indicates a lower risk for lenders. A good credit score demonstrates responsible credit management. Also, it increases the likelihood of obtaining loans, credit cards, and favorable interest rates.

Find Mortgage Lenders Near You

Find Mortgage Lenders Near You

Find Mortgage Lenders Near You

View 138+ Lenders in the US

Find Mortgage Lenders Near You

View 0 Homes For Sale in the US

Where do you want to live?

Understanding Different Credit Score Models

Lenders use credit scores as a tool to make lending decisions. FICO (Fair Isaac Corporation) and VantageScore produce various credit scoring models for them. Both companies regularly introduce new versions of their models.

Here’s how their range mechanisms differ from each other:

FICO

FICO produces two categories of scores: base scores and industry-specific scores. Its base scores predict a borrower’s capacity to repay debt by considering their comprehensive credit history, spanning from 300 to 850.

Industry-specific scores, on the other hand, forecast a borrower’s ability to repay a particular type of debt, such as an auto loan or mortgage, with a range from 250 to 900.

VantageScore

The VantageScore model exclusively calculates base scores and does not produce industry-specific scores. When it was initially introduced in 2006, the scoring model had a scale extending from 501 to 990.

However, this range shifted with the release of VantageScore 3.0, which now spans from 300 to 850. This pattern continues with VantageScore 4.0 which simplifies the comparison of consumers.

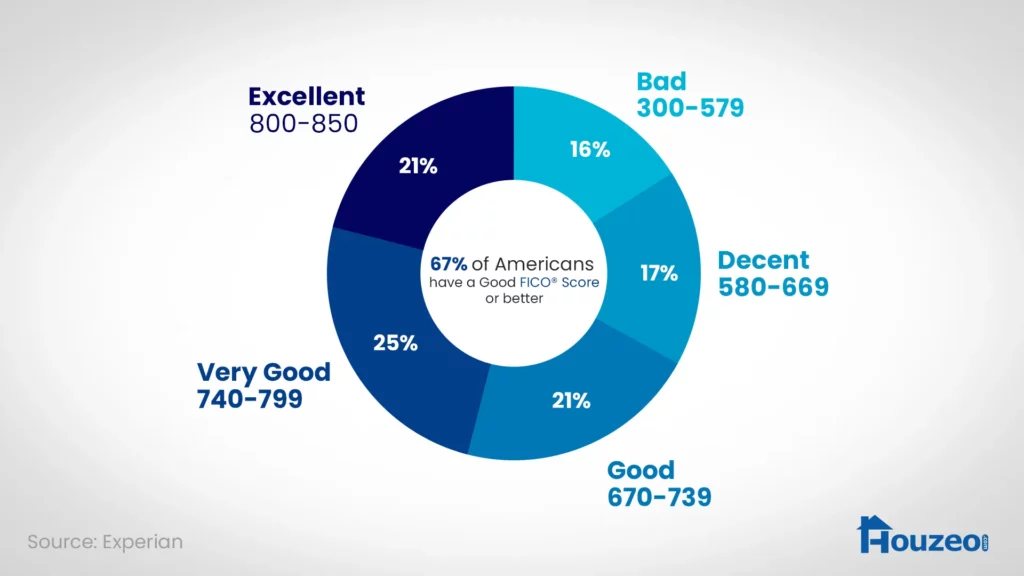

What Is a Good FICO Score?

A good FICO score should be in the range of 670 to 850. The lenders use FICO scores to assess an individual’s creditworthiness.

Here’s a representation of a good credit score range:

A higher FICO score indicates a lower risk and better chances of obtaining credit at favorable terms. However, it’s important to note that the interpretation of a good FICO score may vary depending on the specific lender or industry.

Generally, scores above 700 are excellent, while scores below 580 are poor.

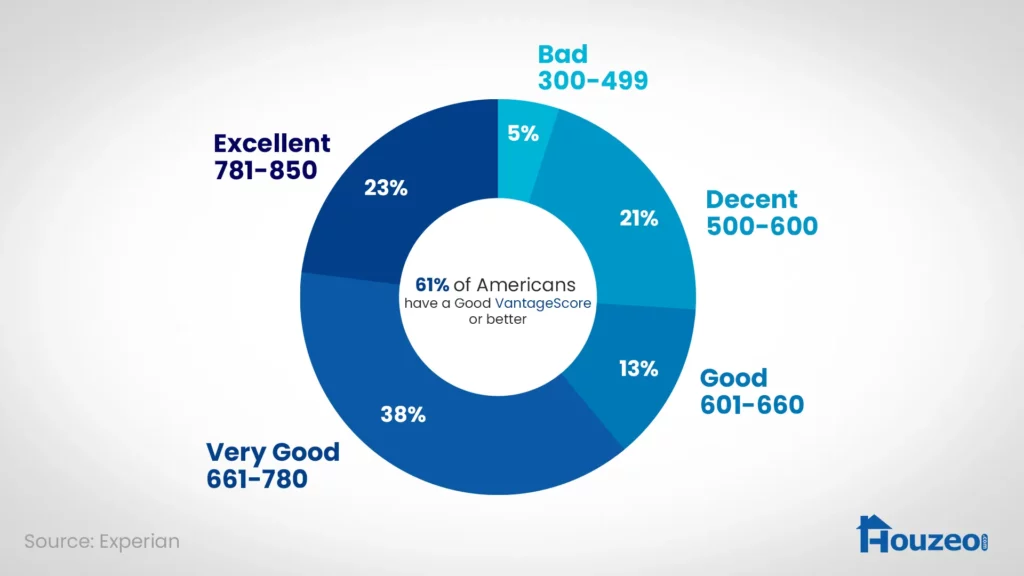

What Is a Good Vantage Credit Score?

A good VantageScore should be in the range of 601 to 850. Here is a graph to illustrate the different ranges:

Similar to the FICO score, a higher VantageScore indicates a lower credit risk and improves credibility.

You should aim for a higher VantageScore to enhance your financial opportunities.

What Factors Affect Your Credit Score?

Several factors can significantly impact your credit score. To maintain your credit ratings, you must understand these crucial elements:

- Payment History: Your payment history has the most significant impact on your credit score. It covers whether you make on-time payments on your invoices, any late payments, and any bankruptcies.

- Credit Utilization: Credit utilization refers to the percentage of your available credit that you’re currently using. Having a low credit utilization, ideally below 30%, demonstrates responsible credit management.

- Credit History Length: A longer credit history provides more data for lenders to assess your creditworthiness. It includes the age of your oldest account and the time of most recent account activity.

- Credit Mix: Lenders prefer to see a variety of credit kinds, including credit cards, loans (such as auto loans and mortgages), and lines of credit. Your score may increase if your credit portfolio is diverse.

- Applications for New Credit: Applying for a new credit can temporarily lower your credit score. It’s advisable to limit the number of new credit applications within a short period of time.

- Public Records and Collections: Negative public records, such as bankruptcies, tax liens, or civil judgments, can significantly impact your score.

It’s important to note that different scoring models, such as FICO and VantageScore, may weigh these factors differently.

What Is a Good Credit Score to Buy a House

Aim for a FICO score of 670 or higher to improve your chances of mortgage approval and qualify for a lower interest rate. The credit score required to purchase a house can vary between 500 and 700, depending on the mortgage loan type you’re seeking and the lender you choose.

To purchase a house with a conventional loan, most lenders typically demand a minimum score of 620. Other types of loans require different approvals:

- For FHA home loans, you usually need a credit score of at least 500 to make a 10% down payment or 580 to make a 3.5% down payment.

- USDA loans do not establish a specific requirement, though lenders generally ask for a minimum of 580.

- VA loans also don’t specify a fixed minimum score, lenders commonly ask for 620 or higher.

➡️Also Read: What Is Basis Points?

Find Homes for Sale Under Your Specific Budget

How to Improve Your Credit Score?

Consistent efforts and wise financial practices are necessary to maintain a good credit score. Here are some steps you can take to improve your credit score:

- Pay Bills on Time: Timely payments are crucial for a good credit score. Ensure to pay your credit card bills, loans, and other commitments by their due date.

- Keep Credit Card Balances Low: Maintain low balances in relation to your credit limits, it will positively impact your score. Aim for a credit utilization ratio below 30% to show responsible credit usage.

- Establish a Credit History: Build a good credit history. Apply for a credit card or get a small loan and make regular payments to start building a positive credit history.

- Monitor Credit Reports: Regularly check your credit reports for accuracy and identify any errors. Inaccurate reporting can harm your score, so address discrepancies promptly.

Remember, improving your credit score is a gradual process. By adopting the above steps, you can achieve a good credit score over time.

Bottom Line

In conclusion, a good credit score is crucial for financial stability. It opens doors to favorable interest rates, higher credit limits, and loan approvals.

Maintain your credit history, pay bills on time, and manage credit utilization. Most importantly, a good credit score is a stepping stone for realizing your homeownership dream.

Find Your New Home With Houzeo

With thousands of property listings, Houzeo.com is one of the biggest property listing sites in the US. Find condos, townhouses, co-ops, and other types of homes for sale on Houzeo.

Find Your Dream Home 🏡

Find Your Dream Home 🏡

Find Your Dream Home 🏡

View + Inspectors in the US

Find Your Dream Home 🏡

View 17,087,422 Homes For Sale in the US

Where do you want to live?

» Need More Clarity? Read these exclusive Houzeo reviews and learn why the platform is the best in America’s competitive housing market.

Frequently Asked Questions

How long does it take to get a good credit score?

The timeline for building good credit varies depending on your starting point and the challenges you encounter.

How do I find out what my credit scores are?

You can obtain your scores directly from Equifax and TransUnion. Additionally, you have the right to receive free annual credit reports from them.

How to get a 850 credit score?

According to FICO, nearly 98% of individuals classified as "FICO High Achievers" have a perfect track record with no missed payments. Among the remaining 2%, those who did have missed payments had, on average, experienced the missed payment about four years ago. Therefore, maintaining a consistent record of timely payments is the sole path toward eventually achieving an 850 credit score.

.webp)