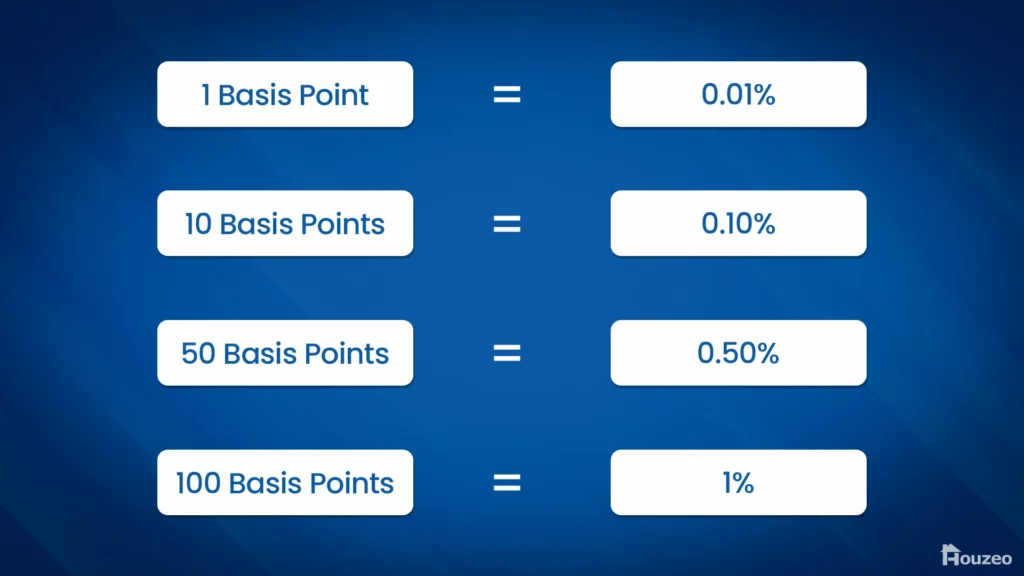

Basis points (BPS) are a simple way to measure small changes in financial metrics, like interest rates or investment returns. One basis point equals 0.01%, so a change of 25 basis points equals a 0.25% change.

Basis points help you to understand how small changes affect your monthly mortgage payments. If your interest rate of 5.5% increases by 50 BPS, your new interest rate will be 6%. That’s thousands of dollars over the life of the loan!

To secure the best interest rates, it’s important to get pre-approved for a mortgage. This gives you a clear idea of your borrowing power and helps you lock in favorable terms before interest rates fluctuate further.

What Are Basis Points?

Basis points, often abbreviated as BIPS/BPS/BP, are a financial unit of measurement. They are used to express the smallest changes in interest rates or percentages. One basis point is equal to 0.01%, or one-hundredth of a percentage point.

How to Use Basis Points?

These points are precise and standardized units of measurement, typically used in the finance sector. BPS are used to:

- Measure Small Changes: BPS are used to express minor fluctuations in rates like interest rates, bond yields, and mortgage rates.

- Negotiate Contracts: BPS serve as a negotiation tool in contracts. They allow parties to adjust interest rates or fees with precision.

- Evaluate Investment Returns: Investors compare yields using BPS, where minor changes can affect returns significantly.

- Simplify Financial Communication: BPS provide clarity in discussions about mortgages and financial markets.

- Manage Risk: BPS help quantify risks in financial instruments. Investors can assess and manage market volatility effectively.

How Do BPS Work In Mortgages?

When it comes to your mortgage, you can use BPS to:

- Compare Lenders: You can easily weigh your lender options in terms of BPS to choose the best deal. If one lender offers a 3.75% rate and another offers 3.5%, the difference is 25 BPS.

- Evaluate Loan Approvals: A change in basis points can affect your ability to qualify for a mortgage. A higher rate increases monthly mortgage payments, making approval harder.

- Determine Loan Costs: When lenders adjust interest rates by basis points, it directly influences the total cost of the loan over time. Even a small change in BPS can result in a noticeable difference in long-term payments.

How to Calculate BPS?

BPS calculation is a straightforward process. To convert a percentage change to basis points, multiply by 100. To convert basis points to a percentage, divide by 100.

Take, for example, a $300,000 loan with a 30-year term, where the interest rate has increased by 50 basis points. With the initial rate of 4%, your monthly payment would be around $1,432. However, with the increased rate, the payment rises to approximately $1,520.

So, even a small BPS change can have a significant impact on your monthly mortgage payments.

Why Should I Use Basis Points Instead of Percentages?

BPS offer more precision when discussing small changes in interest rates, fees, or financial metrics. Here’s why you should use basis points instead of percentages:

- Clarity for Small Changes: BPS simplify the measurement of granular financial adjustments. It is a simple yet precise way to represent the smallest shifts in interest rates or bond yields.

- Avoid Confusion: Percentages can sometimes be unclear when discussing rate changes. For example, if a financial instrument moves from 2% to 3%, is that a 1% increase or a 50% increase? BPS eliminates this confusion.

- Consistency Across Financial Products: BPS offer a standardized way to compare financial products like mortgages or bonds.

Why Are Basis Points Important?

One basis point is equal to 0.01%, or one-hundredth of a percentage point. BPS offer a standardized system to express even the smallest changes in financial rates. This ensures clarity in discussions around interest rates, loans and investments.

BPS allows borrowers to accurately compare lender offers and secure the best interest rates. They also highlight how small rate changes impact total loan costs. This helps you make informed financial decisions throughout the loan’s duration.

Frequently Asked Questions

Are basis points and percentage points the same?

No, basis points and percentage points are not the same. A basis point (BPS) equals 0.01%, while a percentage point refers to a 1% change.

Why basis points and not percentage?

You should use basis points instead of percentage points because basis points provide more precision and clarity for small changes. They help avoid any potential confusion.

How are basis points calculated?

You can calculate basis points by multiplying the percentage change by 100. For example, a 1% change equals 100 basis points (1% × 100 = 100 BPS).