Seller closing costs in Missouri typically range from 6.25% to 9% of the home selling price. That’s a whopping $14,994 to $21,591 that you have to pay if your home is valued at $239,900.

Is there any scope to lower this amount? YES! The 6% Realtor commission is a big chunk of seller closing costs in the Show-Me State. You can reduce it to just 3% and save approximately $7,197 in listing agent fees.

How? By opting for a Flat-Fee MLS listing service like Houzeo.

With Houzeo, not only are you saving a ton of money in closing costs, but you can also get assistance when pricing your home. This way, you have the upper hand when you market your home and negotiate with potential buyers.

What Are Seller Closing Costs in Missouri?

These are costs that you pay at the end of your real estate transaction. Seller closing costs can be divided into 4 main categories:

- Property Closing Costs: These include fees related to preparing your home for sale, such as inspection costs and warranty fees.

- Mortgage Closing Costs: If you took a loan to buy your home, you will have to pay off the remaining mortgage before the sale.

- Administrative Fees: These costs mainly cover Realtor commissions, escrow fees, and settlement fees that are paid at closing.

- Government Fees and Real Estate Taxes: These are the costs imposed by the local authorities.

What Do Seller Closing Costs in Missouri Include?

Here is a comprehensive breakdown of what’s included in seller closing costs in Missouri:

Property Closing Costs

- Home Inspection Fee: The average home inspection cost in Missouri is around $325 to $400. It can help you identify the issues you must fix before listing your house for sale.

- Home Warranty Fee: The monthly cost of a home warranty fee depends on the company you choose. It ranges from $35 to $85. It covers maintenance costs for appliances like refrigerators, dishwashers, etc. for a limited time.

- Title Search: Its cost ranges from $35 to $250. It verifies the property’s legal ownership by examining documents like deeds, tax liens, court judgments, etc., to uncover unknown claims or liens.

- Municipal Lien Search: It costs around $100 to $125. It reports unrecorded code violations, taxes, and utility bills linked to a property.

- Owner’s Title Insurance: The cost of owner’s title insurance in Missouri is 0.5% to 1% of the property’s value. It protects the buyer from ownership discrepancies and false documentation. This covers back taxes, liens, and ownership clauses.

- Utility Bills: You must pay for utilities, like water, gas, electricity, etc., till closing. The title company checks for unpaid bills and utility liens.

Mortgage Closing Costs

- Mortgage Payoff: You must pay the remaining mortgage balance, accrued interest until closing, and prepayment penalties. The prepayment penalties can reach up to 2% of the outstanding balance.

Administrative Fees

- Real Estate Agent Commission: You might have to pay 5% to 6% of the sale price in Realtor commissions. This includes the listing agent and the buyer’s agent fees. To cut down the commission in half consider going FSBO in Missouri.

- Escrow Fee: A third party, known as an escrow, holds the property funds until the contract’s conditions are met. It typically costs around 1% to 2% of the purchase price, which is split between the buyer and the seller.

- Settlement Fee: The settlement agent transfers the title from the seller to the buyer. Depending on state laws, you pay the settlement fee to the agent, title company, escrow company, or attorney.

Government Fees and Real Estate Taxes

- Property Tax: The tax you have to pay depends on the property value, which can be around 0.67%. The local governing body imposes this tax at closing. The prorated property tax is settled according to the purchase date.

- Homeowner Association (HOA) Fee: It charges monthly $100 to $500 for common area maintenance in Missouri. If you fail to pay this fee, the HOA may foreclose on your home.

- HOA Estoppel Fee: The estoppel fee ranges from $100 to $500. It’s a legally binding document that outlines buyers’ post-closing financial obligations like monthly fees and outstanding dues.

- HOA Transfer Fee: The fee is $100 per applicant. If your house comes under HOA, then during closing, you must transfer the ownership of the home to the buyer in the HOA records.

Seller Closing Costs Calculator for Missouri

Use this free seller closing cost calculator to get an estimate of how much you’ll need to pay when selling your home.

How to Reduce Seller Closing Costs in Missouri?

These tips can help you reduce your seller closing costs:

1. Opt for a Discount Broker

Unlike traditional brokers, who charge 6% of the sales price as commission, discount real estate brokers in Missouri only charge between 0.5% and 2%. Some low-commission Realtors offer higher concessions if you let them represent you for your next real estate purchase.

2. Choose “For Sale By Owner”(FSBO)

Sellers can save up to 3% commission and cut several costs by opting for FSBO websites in Missouri. Houzeo offers Flat Fee MLS packages for FSBO sellers that list properties on the MLS and make the selling process easier and pocket-friendly.

How to List on MLS With Houzeo?

5 Easy Steps to List on MLS with Houzeo as FSBO

3. Negotiate Better Rates

Negotiation can save you thousands in seller closing costs. Instead of accepting the standard rates of attorneys, title companies, and appraisers, discuss better rates with them to reduce overall expenses.

» Real Estate Attorneys in Missouri: Find the best real estate attorneys near you.

4. Negotiate With the Buyer

Buyers are the ones who predominantly pay the closing costs in Missouri. But it can be split between the buyer and seller. Discuss with your buyer what expenses they are willing to pay and bargain to reduce your closing costs.

Bottom Line

Seller closing costs can affect your profits and play a key role in determining how to price your house for sale. Understanding these costs is essential for maximizing your financial returns.

In Missouri, you cannot avoid paying seller closing costs, but you can decrease them by going FSBO and listing your home on a Flat-Fee MLS service like Houzeo.

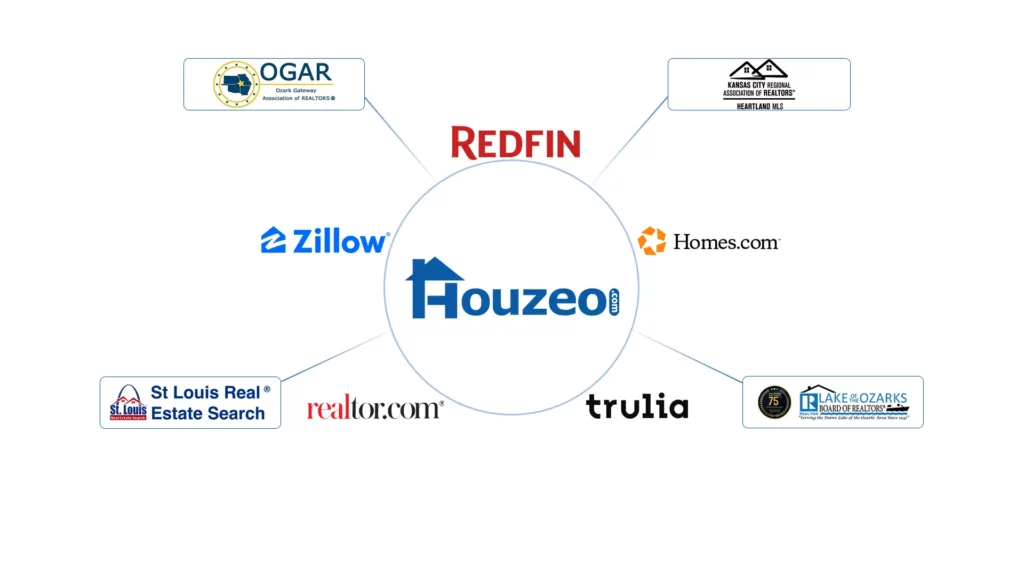

If you list through Houzeo, you can avoid the listing agent commission and save up to $12,000. Through Houzeo, your home is not only listed on the MLS but also syndicated to popular real estate websites like Trulia, Zillow, and Redfin.

Eager to Know How Houzeo Works?

We’ve got you covered. Check out the following video to understand how Houzeo works and why it is one of the best For Sale By Owner websites in the U.S.

» NEED MORE CLARITY? Read these exclusive Houzeo reviews and learn why it is one of the best Flat Fee MLS Listing services in America.

Frequently Asked Questions

How much are closing costs for the seller in Missouri?

Seller closing costs in Missouri range from 6.25% to 9% of the home selling price.

It also depends upon many factors like taxes, mortgage payoff, property closing costs, etc. You can use a seller closing cost calculator to get a proper estimate of how much you will need to pay in the real estate transaction.

How to avoid closing costs when selling a house?

You cannot avoid seller closing costs in Missouri. However, you can reduce it by:

1. Choosing a discounted real estate broker.

2. Opting for For Sale By Owner.

3. Negotiating improved rates with the involved parties.

4. Negotiating with the buyer.

Why are closing costs so expensive in Missouri?

Realtor commission is a major chunk of seller closing costs and is around 3% to 6%. You can cut this down by half by opting Flat Fee MLS Listing service in Missouri, thereby skipping the listing agent's fee.

.webp)