Note: Ribbon Home shut down its cash offer service in November 2022.

With Ribbon Home, you can buy before you sell your existing property by securing a cash down payment. Ribbon charges 1% of the home-buying value and claims to have a 100% on-time closing rate.

Ribbon has stopped extending cash offers since November 2022. If you’re looking for an alternative, try listing your home on the MLS with flat fee companies like Houzeo. You can get multiple offers from difference cash buyers across the country.

An MLS listing on a cash buyer marketplace like Houzeo can get you 100% of your property’s value. With Houzeo, your listing can be on the MLS within 24 hours. Moreover, you can compare offers from multiple national and local cash buyers, instead of settling for just one lowball offer.

In this blog, let’s look at Ribbon Home reviews and their alternatives to help you get the property value you deserve!

What is Ribbon Home?

Ribbon Home is a home financing company that helps home buyers buy before selling their homes by backing their offers with cash. The company guarantees to close on a home with cash-backed and contingency-free offers.

In comparison to its competitors, Ribbon Real Estate’s service fees are lower. The company makes cash offers for buyers who are facing problems in closing due to delayed loan procurement.

Ribbon – At Quick Glance

| Founded | 2017 |

| Services | RibbonRescue, Ribbon reserve, Ribbon Boost |

| Service Fees | Boost: 1% of home purchase price Reserve: 2-2.75% of home purchase price Ribbon Rescue: 3.25% of home purchase price |

| Locations | Ribbon home services are spread across North Carolina, South Carolina, Tennessee, Texas, Georgia, Florida, Alabama, Illinois, Indiana, Michigan, Missouri, Oklahoma, Virginia, Ohio, Colorado, and Kentucky. |

Where does Ribbon operate?

Ribbon Home services cover 64% of the USA, which are:

- North Carolina

- South Carolina

- Tennessee

- Texas

- Georgia

- Florida

- Alabama

- Illinois

- Indiana

- Michigan

- Missouri

- Oklahoma

- Virginia

- Ohio

- Colorado and

- Kentucky

What are the services Ribbon provides?

Ribbon Real Estate provides three services, along with an iOS app facility. Here is the list of services based on the buyer’s situation:

Ribbon Boost

Ribbon Boost is a standard cash service of the company. After taking approval from a third party, the buyer closes the deal with their financing. The Ribbon will receive 1% of the deposits for their fee, and the remainder will serve as a closing credit.

Ribbon Reserve

Ribbon Reserve is available for buyers who have entered into the contract alone but need help closing because of the delayed mortgage.

In this case, Ribbon real estate closes the deal with cash. Ribbon Homes buys the home and rents you for 180 days at a cost of 2-2.75% until your financing comes through.

Ribbon Rescue

This Ribbon plan will save your deal if you’ve entered into a contract on your own but are experiencing mortgage delays. Ribbon will then rent the home to you for 180 days until your mortgage is approved.

Ribbon Home Buying Process

In case your mortgage is not finalized on time, Ribbon real estates come to the rescue with their services, where the company buys the home, and later when your finances are approved, they will sell it back to you at a cost of 2-2.75%.

Here is the step-by-step process of the Ribbon:

- Look for a lender and get a pre-approval letter: Your preapproval letter from your mortgage lender determines how much Ribbon will lend you.

- Home Hunting: When you send Ribbon the homes you’re interested in, they’ll tell you the maximum value for each home, which is called “Ribbon Max Value.”

- Ribbon Boost cash Offer: Once the seller accepts and your financing comes through, you’ll become the homeowner and start making payments. You have to pay 1% of the purchase price to Ribbon real estate for their service.

- Ribbon Reserve (If necessary): You can opt for Ribbon Reserve when your finances are not ready. Here you rent the home from Ribbon for 180 days at a cost of 2-2.75% until your financing comes through.

How much does Ribbon cost?

They earn by charging 3 main costs, which are:

- Boost Cost: Ribbon Boost, as long as your finance comes through on time, you can utilize the Ribbon Boost, and pay 1% of the purchase price, along with 4-6% agent commission and 2-5% buyer closing costs.

- Reserve Costs: Ribbon Costs, in case of a delay in the financing, Ribbon reserve will purchase your home and rent it to you for 180 days at almost as much as the mortgage, plus 4-6% agent commissions and 2-5% buyer closing costs.

- Rescue cost: Imagine where you are already under the contract, but your finance doesn’t turn up on time. Sounds scary, right? Ribbon Homes comes to the rescue and close the deal with cash for 3.25% of the purchase price along with an Agent commission of 4-6% and buyer closing costs of 2-5%.

Is Ribbon Home Legit?

Yes, Ribbon Real Estate is a legitimate company based in New York. The company was founded in 2017 and deals in debt financing. Ribbon Home has facilitated 7,000+ home purchases and has enabled $5 billion worth of buying power.

Customer Reviews

The Ribbon Real Estate has a 4.4 out of 5-star rating on Trustpilot with 154 reviews and 3.4 out of 5 stars on Glassdoor with 152 reviews.

Almost 80% of the reviews state that they had an amazing experience with Ribbon real estate.

Prompt and Reliable Process

Customers are satisfied with Ribbon Home’s fast and reliable services.

They Can Take The Reign Off

Ribbon home services were excellent, Christine believes that the company’s presence in the process allows fo pivotal conversation.

Ribbon Home Was Responsive

Dwan Johnson had an excellent experience with Ribbon homes, as the company was very responsive and well organised.

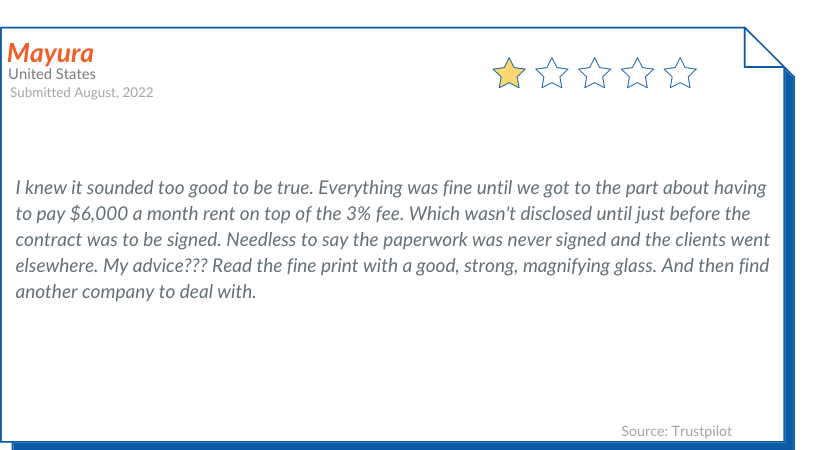

Backed Out At The Last Moment

Christine faced the nightmare of all the house buyers, as Ribbon Homes pulled out of the deal.

Sounded Too Good To Be True

Mayura had a horrible experience as the company didn’t disclose all the prices before the final deal.

Ribbon Home Reviews: Pros and Cons

| Reasons To Choose Ribbon Homes | Reasons Not To Choose Ribbon Homes |

| ✅Budget-friendly fee of 1%. | ❌ Ribbon estate began with a 1% fee, but gets costlier from 1% to 2.75%. |

| ✅ Freedom to select your agent. | ❌ No guarantee that your old home will sell. |

| ✅ Saves you when your finances don’t turn up on time. | ❌ End up losing a new home. |

| ✅ Ribbon’s Max Value determines the maximum value of the property. | ❌ Staying in a new home on rent without generating any assets. |

| ❌ Ribbon backed out of the deal after signing all the relevant documents. |

Alternatives to Ribbon Home

Following cash-offering companies empower home buyers to make appealing cash offers on homes, similar to ribbonhome.com:

1. Homeward

Homeward helps you make a cash offer on a house in three ways:

- Buy Before You Sell: Homeward purchases new property in full cash before you sell the existing one. You move into the newly purchased home, list and sell the old one, and use the proceeds to repurchase your new home from Homeward.

- Buy With Cash: To make your offer more competitive Homeward backs it with cash. Unlike buy-before-sell, you need not sell your existing house. Homeward Buy Before Sell empowers first-time home buyers to make cash offers.

- Cash-Backed Offers: If your mortgage financing falls through, the Homeward backs your offer with cash. A cash-backed offer from Homeward will strengthen your bid but will leave you on the hook to pay a 1% fee, even if you do not use the entire cash.

» Homeward Reviews: Discover how Homeward differs from other cash-offering companies

2. Homie Cash

Homie Loans announced Homie Cash™, a program that allows buyers to make all-cash offers to increase their chances of winning the perfect home drastically.

The company levels the field by allowing buyers that don’t have hundreds of thousands of dollars in their bank accounts to become cash buyers and compete against investors and iBuyers like Opendoor, Offerpad, etc.

As a buyer, you need to understand that you still need to get a traditional mortgage to pay back Homie Loans. This means you have two closing costs and end up spending more than necessary on one transaction!

» Homie Reviews: How this cash offering company works?

3. Opendoor Cash Offers

To gain a secure cash offer through Opendoor you need a mortgage pre-approval first. Opendoor pairs you with one of their agents to help you figure out your budget. The Opendoor agents also help you negotiate various contingencies involved.

Once the seller accepts the bid, Opendoor will purchase the house in total cash and hold it for you. In the meantime, you can shop for the mortgage and buy back your house from Opendoor.

» Opendoor Reviews: Everything you need to know about Opendoor Cash Offers

4. HomeLight Cash Offer

Homelight is a cash offer company that deals in both buying and selling houses. The company is willing to make cash offers on your behalf and resell it to you if you meet their cash-buying criteria.

The company offers guaranteed closing. This makes Homelight stand apart from other cash financing companies.

» Homelight Cash Offer Reviews: Read what cash home buyers have to say about Homelight

📞 Need Help? Schedule a FREE Consultation

A Houzeo expert can answer all your questions regarding our technology.

Book a FREE Call

Frequently Asked Questions

Is Ribbon an iBuyer?

No, iBuyers uses technology to make instant offers, whereas Ribbon real estate enables individuals to make all-cash offers.

Is Ribbon a bridge loan company?

No. The ribbon does not offer bridge loans, they work with lenders to provide flexible options to individuals who want to buy a home.

How to get started with Ribbon?

Homebuyer or sellers can contact their agents, whereas if you are a buying agent, you can create an account on Ribbonhome.com.

.webp)