Homeward is a home financing service based in Austin, TX. They help sellers get up to 88% of the FMV. Moreover, Homeward empowers buyers to purchase their dream house before selling their existing home.

Editor’s Rating

User Rating

(1 Reviews)

Write a review

Pros

- Purchase your new home without selling the old one

- Close in as little as 14 days

- Use your own financing solutions

Cons

- Not available in all markets

- Strict eligibility criteria

Homeward is a home financing service. They offer three programs – ‘Sell to Homeward’, ‘Buy Before You Sell’, and ‘Make a Cash Offer’. Their signature ‘Buy Before You Sell’ program lets you buy a new home without selling your old one.

Homeward’s ‘Make a Cash Offer‘ empowers you to move into your dream house without having an old home. Homeward purchases your new home for cash on your behalf. So, you move into your new house and gradually pay off the mortgage.

If you just want to sell your house, you can opt for ‘Sell to Homeward’. You get a cash offer of up to 88% of the FMV for your home. Moreover, you receive your proceeds within 21 days after closing. Depending upon the program you choose, Homeward charges fees and rent.

-

✍️ Editor’s Take: We recommend listing your property on the MLS via Houzeo. You get multiple cash offers on the MLS which you can manage using Houzeo’s tech-centric dashboard.

Is Homeward Real Estate Legit?

Yes, Homeward Financial is a legitimate company. Tim Heyl founded Homeward in 2018. They are headquartered in Austin, TX, and cover 7 states.

The company provides three services: Homeward Offers, Homeward Mortgage, and Homeward Title. You should compare the pricing of your mortgage lender and title company before opting for these Homeward services.

-

✍️ Note: Homeward has affiliated mortgage and title services. However, choosing the Homeward title and mortgage is optional.

Homeward Programs

» Jump to: Sell to Homeward | Buy Before You Sell | Make a Cash Offer

Homeward offers 3 programs to home buyers and sellers. These are as follows:

1. Sell to Homeward

The Sell to Homeward program is for sellers who want up-front cash. Homeward extends a cash offer of up to 88% of the FMV. You get a cash offer within 24 hours after you complete your application. Moreover, Homeward transfers your funds within 21 days after closing.

After this, Homeward works with your agent to list your old home on the MLS. Once your home sells on the market, the upside or profit made on that sale will be transferred to you.

How Much Do You Pay?

Although you don’t pay anything until closing, you do pay a 5% program fee on the sale price of your home.

-

✍️ Note: If your home sells for less than what Homeward paid, you don’t have to pay them back. This takes away the stress of dealing with a loss on the property.

2. Buy Before You Sell

Homeward’s Buy Before You Sell Program helps you buy a new house for cash before selling your existing property. They do this by making a cash offer on your behalf.

Moreover, Homeward lists the old property on the MLS with your agent to secure top-dollar deals. They take care of staging and photography too. You can use the proceeds from your old property to buy back your new home from Homeward Inc.

How Much Do You Pay?

You pay 2.4% of the sale price to use the Buy Before You Sell Service. You get a credit of 0.5% if you opt for Homeward Mortgage. So, the total fee comes down to 1.9%.

You also have to pay an Earnest Money Deposit of 2% to 4%, depending on if your property is valued above or below $1M. Homeward credits these funds to your down payment at the time of closing.

Moreover, when you move into the new house, you need to pay prorated rent for the number of days you stay.

-

✍️ Note: Homeward does not mark up the price when you buy back your new house from them.

3. Make a Cash Offer

Homeward’s Make a Cash Offer Program is very similar to the Buy Before You Sell Program.

In Buy Before You Sell you need to sell your house in exchange for a new one. In Homeward’s Make a Cash Offer program, you don’t need to sell your existing home to buy a new one.

Homeward makes a cash offer on your behalf while you search for a mortgage and make other arrangements. You can close in as little as 14 days with this program.

How Much Do You Pay?

You pay a 1.9% standard program fee to use this service. If you opt for Homeward Mortgage, you get a credit of 1%, bringing your total cost to 0.9% due at closing.

-

✍️ Note: Homeward does not inspect your old house. You are responsible for conducting the inspection.

Other Homeward Services

Homeward offers two other services. These are optional services. We recommend comparing the interest rates and title fees of your chosen company with Homeward’s before making any decision.

- Homeward Mortgage: Homeward provides financing solutions to home buyers. Instead of hunting for a mortgage lender, you can opt for Homeward Mortgage. You also become eligible for 1% credit using this service.

- Homeward Title: They function like a traditional title service. There are two contracts and closings when working with Homeward. When you use them for both, you avoid duplicate fees.

Homeward Locations

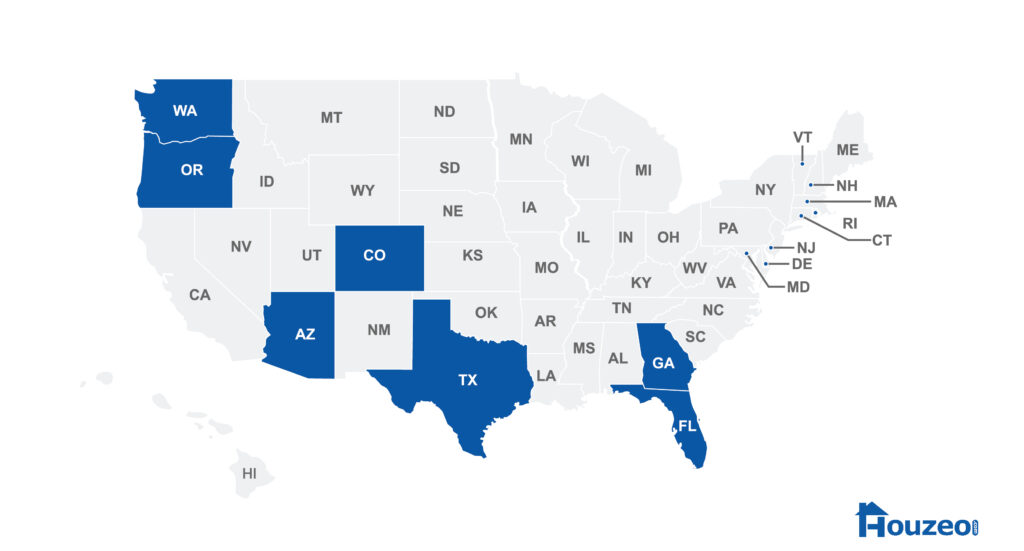

They are available in 7 states – Texas, Georgia, Arizona, Washington, Florida, Georgia, Colorado, and Oregon. The company offers all the Homeward cash offer programs in these seven states.

-

✍️ Note: According to their website, Homeward plans to extend their operations to California in the near future.

Homeward Reviews

The company has a 4.3 out of 5-star rating on Trustpilot across 292 Homeward reviews.

Homeward Reviews: Praises

✅ Christian Beatty feels that Homeward is amazing to work with. Homeward helped them move into their new home sooner.

Using Homeward helped us in a number of ways throughout the process. For one, we had a stronger negotiating position when we found the house we wanted. Then, we were able to move in sooner. My account manager Eric Layton was amazing to work with – very transparent throughout the process and I genuinely felt like he had our best interests at heart.

Source: Trustpilot

✅ Verena loved saving money through Homeward Title and Mortgage service. She highly recommends the company.

I cannot say enough good things about Homeward, the people they help and the people who work for them. An absolutely seamless process, we were able to sell our home and move into a much needed bigger space SEAMLESSLY. 10/10 – HIGHLY RECOMMEND!

Source: Trustpilot

Homeward Reviews: Complaints

❌ D-Mitchell did not appreciate the unresponsive behavior of Homeward employees. They did not connect with her after she signed the contract.

We had a horrible experience with this company. We had trouble getting anyone to call us back to answer questions. The people were very communicative till we signed the contract and that’s when it ended. The paperwork was far off what the final paperwork said. It took 5 months for our other house to sell and the rent was outrageous. They made us pay all the taxes even though we were only ther 3 months of the year.

Source: Trustpilot

❌ Leah M is frustrated with the opaque process followed at Homeward. The actual program fee was disclosed to her one hour before closing.

Fees not fully disclosed until less than 1 hour before closing. Because you have already moved in when you close- because of the program, you have no choice but signing. The actual fees were 80% higher than initial disclosure. Initial fees not disclosed upfront- so although very nice people- opaque process.

Source: Trustpilot

Homeward Reviews: Pros and Cons

Let’s have a look at the pros and cons of Homeward to see if they are the ideal choice for you.

👍Pros

Here are the pros of working with Homeward Inc.

- Get credit with Homeward Mortgage: Homeward offers 1% credit to home buyers when they opt for their financing service.

- Guaranteed sales: Homeward purchases your existing home if it fails to sell on the market.

- Use your lender and agent: You have the freedom to choose your lender and agent while working with Homeward.

- Receive a Higher FMV: You get a whopping 88% of the FMV for your home.

- Close quickly: You can close in as little as 14 days.

- Move hassle-free: You avoid the hassle of moving into a temporary home with Homeward’s ‘Buy Before You Sell’ program.

👎Cons

Here are a few cons of Homeward cash offers you need to know beforehand:

- Limited coverage: Their coverage is not as extensive. Homeward covers only 7 states.

- Strict eligibility criteria: Although they don’t mention any home eligibility criteria, we could make from their cash offer that must have strict home eligibility criteria.

- Pressure to sell: You don’t know when exactly your home is going to sell. So, you might even accept lowball offers sometimes to avoid paying pro-rated rent long-term.

Homeward Reviews: Are There Any Competitors?

» Jump to: Homeward vs. Houzeo | Homeward vs. Orchard | Homeward vs. Knock

1. Homeward vs. Houzeo

Houzeo is a cash buyer marketplace that lists your property on the MLS and their marketplace. You attract better deals due to maximum exposure. In short, your chances of securing a top-dollar deal improve with Houzeo.

On the other hand, Homeward is a cash buyer that extends a final cash offer for your property. This is usually around 88% of the fair market value. When comparing these figures, it is evident that Houzeo provides you with better cash offers for your property.

| Homeward | Houzeo | |

|---|---|---|

| Sale Price | 88% of the FMV | Up to 100% of FMV |

| Customer Rating | 4.3 stars (200+ reviews on Trustpilot) | 4.9 stars (6,000+ reviews on Google) |

| Closing Timeline | As little as 14 days | 2 to 60 days |

| Fees | ❌ | $399+ |

| Scope for Negotiation | ❌ | ✅ |

| Repair Costs | ❌ | ✅ |

| Compare Offers | ❌ | ✅ |

| Highest and Best Offer | ❌ | ✅ |

2. Homeward vs. Orchard

Orchard is a fin-tech real estate brokerage started in 2017. They cater to both buyers and sellers.

Orchard’s ‘Move First’ program resembles Homeward’s ‘Buy Before You Sell’ program. Like ‘Buy Before You Sell’, their program lets you buy your dream house without simultaneously selling your old house.

Orchard works with the buyer to set the list price. They also make some repairs, if needed, at no upfront cost. Homeward does not provide this repair facility. Instead, they have strict home eligibility criteria.

3. Homeward vs. Knock

Knock is an online mortgage lender founded in 2017. Their featured ‘Knock Bridge Loan’ program helps you get a 6-month interest-free loan. You can use this loan to cover the down payment or clear your old dues.

Knock’s pricing is at par with Homeward’s. But when it comes to coverage, Knock is better. They are spread across 75+ markets in the US. Whereas, Homeward is restricted to just 7 states. So, if Homeward doesn’t cover your area, give Knock a look.

“We Buy Houses for Cash” Companies Near You

There are other “We Buy Houses As Is” companies in the market. You can request offers from multiple cash companies and pick the one that suits you the best.

Other Options You Should Consider

- Sell For Sale By Owner: For Sale By Owner websites help you list and sell a house yourself, saving thousands in agent commissions. Around one-third of home buyers pay in cash. Hence, selling FSBO gives you an opportunity to get 100% FMV of your house in cash.

- Sell to an iBuyer: iBuyers purchase homes needing minimal repairs in as-is condition. They can be a great option if you want to sell your house fast. However, iBuyers have stricter criteria as compared to cash buyers.

- Sell through a Realtor: Traditional Realtors list your property on the MLS and help you at every step of home selling. However, you have to pay them 3% of the home’s sale price for this convenience.

- Sell through Discount Realtors: Discount Real Estate Brokers reduce their commissions to offer affordable services. Their commission varies between 0.5% and 2%. However, they offset these discounts by offering limited services.

Homeward Reviews: Is Homeward Worth Trying?

Yes, Homeward is worth it if you want an upfront cash offer. They help you get around 88% of the FMV for your property with their ‘Sell to Homeward’ program.

Selling to Homeward is a bit challenging. We believe they have strict home eligibility criteria as they offer 88% of the fair market value for your property. You might also need to accept a discounted value to meet your pro-rated rent obligations.

We suggest opting for a cash buyer marketplace like Houzeo, where you’ll receive multiple cash offers. Houzeo provides maximum exposure, increasing your chances of securing better deals.

» Houzeo Reviews: Here’s why 7,800+ home sellers have rated Houzeo 4.9 stars out of 5 on Google and Trustpilot.

📞 Need Help? Schedule a FREE Consultation

A Houzeo expert can answer all your questions regarding our technology.

Book a FREE Call

Homeward Reviews: Frequently Asked Questions

1. Is Homeward a legit company?

Yes, Homeward is a legitimate home financing company founded in 2018 by Tim Heyl. Homeward is located in Austin, TX. They have coverage in 7 states.

2. What are some Homeward competitors?

Homeward has some competitors that offer similar services. These are Houzeo, Orchard, and Knock. Read more about Homeward competitors here.

3. How much does Homeward charge?

Homeward charges a program fee for different programs. Your fee will depend upon the type of program you choose. Click here to learn more about Homeward programs and their fees.

(1 Reviews)

-

Bob

Verified Reviewer

14th Feb 2024

If I could leave no stars I would. Complete waste of time and money. Gave us a fictitious scenario in which started us on house hunting out of state only to decline to offer on our house. Mind you our house is in a very desirable neighborhood. Worth in excess of 800k. Don’t trust the false talk. Company is a joke.

.webp)