Opendoor is a San Francisco-based iBuyer. They extend quick cash offers on homes that need minimal repairs.

Editor’s Rating

User Rating

(11 Reviews)

Pros

- Opendoor gives you a preliminary cash offer within 24 hours.

- You avoid spending thousands of dollars in repair costs.

- Opendoor gives you a flexible closing timeline of up to 60 days.

Cons

- Opendoor extends lowball cash offers that are just 70%-80% of your home's fair market value.

- Opendoor's 5% service fee reduces the total equity you get for your home.

- Opendoor has a strict eligibility criteria for the properties they purchase.

Opendoor is one of the largest iBuyer companies in the United States. They make cash offers on selected properties only.

Opendoor has fixed eligibility criteria that a home must meet for them to make an offer. They purchase single-family homes and townhouses. Apart from this, in specific locations they also buy duplexes and condos.

As per our research, Opendoor offers typically range between 70% to 80% of your home’s FMV. This reduction in the offer amount, combined with the 5% the service fee and 1% closing cost, can impact the total equity you receive for your property.

-

✍️ Editor’s Take: Listing on a cash buyer marketplace is a better way to get FMV for your home. We recommend Houzeo over Opendoor. Houzeo exposes your property to nationwide investors. Moreover, the platform also helps to manage multiple offers. Compare Opendoor vs. Houzeo.

Is Opendoor Legit?

Yes, Opendoor is a legitimate company with control over 67% of the iBuying market. Eric Wu and Keith Rabois founded the company in 2014. They introduced the iBuyer business model that revolutionized American real estate.

The company is headquartered in San Francisco, California. At present, Carrie Wheeler is the CEO of Opendoor. They are a BBB accredited company with an A rating.

In addition to the iBuying business, Opendoor offers other services like refinance, list your home, buy a home, and buy & sell.

Curious about Opendoor’s fate in the real estate market? Here’s our analysis!

How Does Opendoor Work?

Here’s a quick rundown of how the Opendoor offer process works:

- Request an Offer: Provide details about your home on opendoor.com and receive a free estimate.

- Schedule a Virtual Home Tour: If you accept their offer, Opendoor will arrange a virtual home tour, either via video call or by submitting property photos and videos for verification.

- Complete the Home Inspection: Opendoor sends an in-house appraiser to inspect your property. Typical aspects of the home inspection include the foundation, roof, plumbing, electrical, AC units, etc.

- Receive the Final Cash Offer: Opendoor makes a final offer on your house within 2 days. This offer includes their 5% service fee, repair expenses, and the 1% closing cost.

- Close on the Sale: If you accept Opendoor’s cash offer, you can select a closing date up to 60 days out. You will have to upload photos of your home on Opendoor’s online dashboard to prove that its condition hasn’t changed since the assessment.

👉 Important: You will need to move out of your house by 11.59 pm on the day before escrow closes. The cash sale will go through a few days after closing.

What Types of Homes Does Opendoor Buy?

Opendoor has strict eligibility criteria for the homes they purchase. If your property doesn’t meet them, then Opendoor may not make an offer.

To qualify for an Opendoor offer, your property needs to fulfill these conditions:

| Parameters | Criteria |

|---|---|

| Ownership and Occupancy | Clear and marketable title. Property should be owner occupied and vacant at the time of closing. |

| Home Type | Single-family homes, townhouses. Duplexes and condos in certain markets. |

| Valuation | Opendoor buys homes valued between $100K to $600K. But they can buy homes valued up to $1.4 million. |

| Year Built | Houses built after 1930. |

| Maximum Lot Size | 1 to 2 acres of land. |

| Home Location | House needs to be within Opendoor’s coverage area. |

Other Opendoor Services

Here are some additional services Opendoor provides, depending on your location:

- Opendoor Brokerage: You can work with an Opendoor agent if you wish to list your home on the MLS. Similar to a traditional brokerage, you will receive all the assistance you need with Opendoor Realty.

- Opendoor Complete: You can use your Opendoor cash offer for your old home to purchase a new one. Instead of paying two mortgages, you just have to pay the 5% service fee once.

- 90-Day Buyback Guarantee: Opendoor offers a 90-day buyback guarantee for a 3% fee. So, if the house doesn’t live up to your dreams, you can return it in three months.

- Opendoor Home Loans: You can finance your new home with the Opendoor mortgage lending solution. You get competitive interest rates on loans and avoid any extra lender charges. In certain states, Opendoor also offers a credit of $1,000 towards closing.

- Opendoor Title: With the acquisition of OS National in 2019, you can avail of title insurance and escrow services with Opendoor Title.

Opendoor’s Coverage

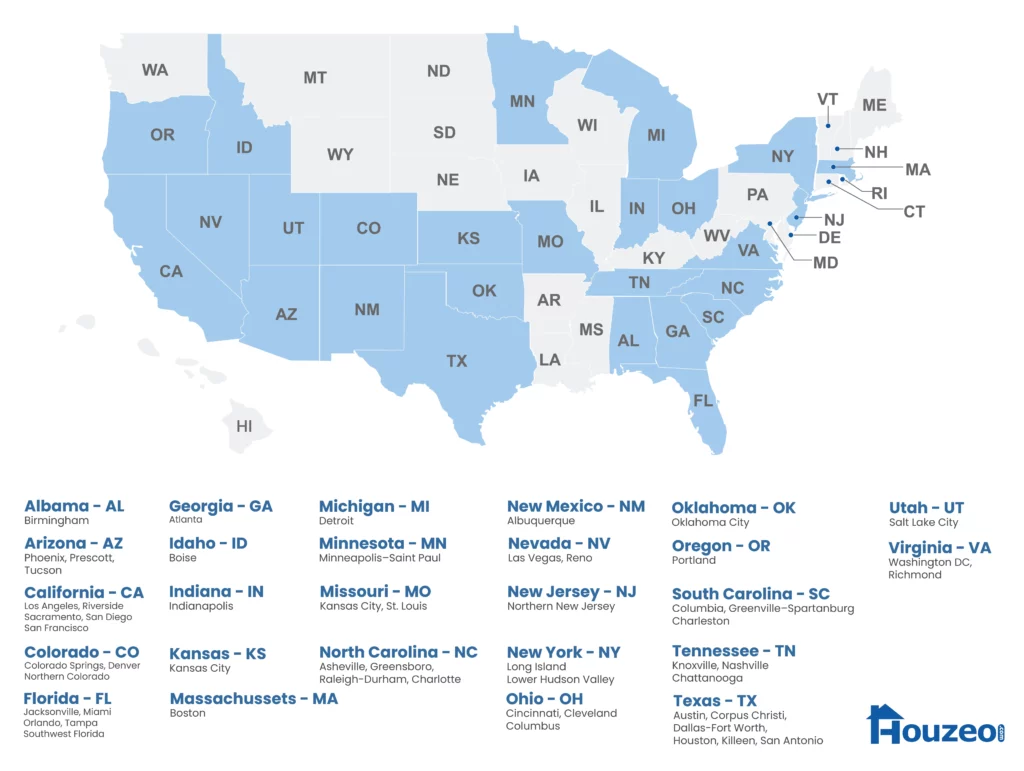

Opendoor has a limited coverage area of just 51 metropolitan cities.

Opendoor’s restricted coverage may force you to turn to the open market. If that is the case, an MLS listing on Houzeo.com is in your best interest. With near nationwide coverage, your listing can be on your local MLS within 24-48 hours.

How Much Does Opendoor Homes Pay?

Opendoor’s preliminary offer is usually 70% to 80% of your property’s fair market value. If you have a turnkey home you may get more.

Opendoor’s cash offer will probably be lower than what you can get on the open market. Further, with the added service fee, repair costs, and closing costs, you may end up leaving a lot of cash on the table.

For example: Your house is worth $500,000 but needs $35,000 in repairs. Opendoor will deduct 5% service fee, repair costs, and 1% closing costs. Let’s calculate the possible final offer from Opendoor:

- Fair Market Value: $500,000

- Repair Costs: $35,000

- Service Fee 5%: 5% of $500,000 = $25,000

- Closing Costs 1%: 1% of $500,000 = $5,000

Total Deductions: $25,000 + $35,000 + $5,000= $65,000

Therefore, based on the above calculations, the estimated final offer from Opendoor would be $445,000.

Opendoor Reviews

Opendoor has a 4.4 out of 5-star rating on Reviews.io based on 3,281 reviews. In contrast, they have a 1.1 out of 5-star rating on BBB based on 228 reviews.

The positive Opendoor reviews praise the iBuyer’s easy process and courteous customer support. On the other hand, Opendoor complaints highlight their lowball offers and high repair costs.

Opendoor Reviews: Praises

✅ Brady was happy with Opendoor’s services. He praised the company’s ease of use, professionalism, and the convenience it provided.

I was working a full-time job and building a new home(personally). I did not have time for a real estate company and dealing with an agent, showings, and all the things that goes into that. Opendoor made it very easy to show my home, proceed through closing, and sell my home with minimal effort…

Source: Reviews.io

✅ Darlene expressed contentment with the entire process of selling a house through Opendoor. She received a quick offer within an hour of the evaluation.

I am very happy and please with the entire experience from the first call to the closing date. This experience if you don’t want to deal with a real estate agent is the best way to go. Zoom your house, next day someone came out took pictures. I had an offer within an hour and was pleased…

Source: Reviews.io

Opendoor Reviews: Complaints

❌ John mentioned that Opendoor initially offered him a high price but later reduced the offer significantly. They claimed that the house needed extensive repairs.

Their initial offer is to get your hopes up. Then they come in and low ball the first offer. And claim the house house needs a lot of work. They told me over 30,000.00 worth of work…

Source: Reviews.io

❌ Lavada alleged that Opendoor provides lowball offers, adds high convenience fees, exaggerates repair costs, and undervalues homes.

This company is horrendous. They will not offer a fair price for your home and then will gouge you at every turn. Exorbitant “convenience fees” and they seem to have a standard of quoting $30,000 in repairs, even when none are needed…

Source: Reviews.io

Opendoor Reviews: Pros and Cons

Here are some pros and cons of Opendoor to see if they are the ideal choice for you.

✅ Opendoor.com Pros

- Instant Cash Offer: You receive a preliminary cash offer within 24 hours after you submit your property information.

- Flexible Closing Timeline: You have up to 60 days to close on your home. They also let you set a date as per your convenience.

- Zero Cancelation Fees: Opendoor doesn’t levy a penalty in case you want to reject the offer or cancel the sale.

- Late Checkout: Opendoor allows you to stay in the home for up to 17 days after the closing date. However, you have to pay additional fees to avail this service.

- Streamlined Process: With Opendoor you can sell your home without the need for open houses, showings, or repair work.

⛔ Opendoor.com Cons

- Lowball Cash Offer: Their cash offers are as low as 70% to 80% of your property’s fair market value.

- High Additional Fees: You have to pay a 5% service fee, repair cost, and a 1% closing cost when you sell your house to Opendoor.

- Strict Eligibility Criteria: Opendoor don’t buy inherited properties, homes with tenants, or properties located in a flood zone, etc.

- No Scope for Negotiation: The cash offers you receive are non-negotiable. You may have to settle for a discounted sale price if you are in urgent need of cash.

- Limited Coverage: Opendoor only offers services in 51 markets.

Opendoor Reviews: Competitors

» Jump to: Opendoor vs. Houzeo | Opendoor vs. HomeVestors | Opendoor vs. Offerpad

1. Opendoor vs. Houzeo

Opendoor’s selling process may appear to be hassle-free. However, you get a reduced offer that is 70% to 80% of your home’s equity. Moreover, you get a cash offer from only one company.

On the other hand, listing your property on a cash marketplace like Houzeo.com can attract multiple offers. Your listing is syndicated to hundreds of real estate websites. So, you market your property to local and national cash home buyers looking for homes for sale.

| Opendoor | Houzeo | |

|---|---|---|

| Sale Price | 70% to 80% of FMV | Up to 100% of FMV |

| Customer Rating | 4.5 stars (3,281 reviews) | 4.9 stars (7,800+ reviews) |

| Closing Timeline | 14 to 60 days | 2 to 60 days |

| Coverage | 51 metro areas | 47 states + Washington D.C. |

| Fees | 5% service fee | $399 |

| Closing Costs | ✅ | ✅ |

| Scope for Negotiation | ❌ | ✅ |

| Repair Costs | ❌ | ✅ |

| Compare Offers | ❌ | ✅ |

| Highest and Best Offer | ❌ | ✅ |

2. Opendoor vs. HomeVestors

HomeVestors are a cash home buyer franchise offering 50% to 70% of a home’s FMV. They have near-nationwide coverage. Moreover, with HomeVestors, you get a chance to negotiate and secure a better deal.

Opendoor’s cash offer can range between 70% to 80% of your home’s equity. They are available only in 51 market areas. In addition, their cash offers are non-negotiable.

3. Opendoor vs. Offerpad

Offerpad also has a similar business model to Opendoor. Offerpad’s closing times may vary depending on various factors such as the complexity of the transaction, local regulations, and other circumstances. Whereas, Opendoor can close withing 14 days.

They have the fastest closing amongst iBuyers. So, if your house needs minimal repairs and you require cash urgently, Offerpad can be a good alternative to Opendoor.

We Buy Houses for Cash Companies Near Me

There are other “We Buy Houses As Is” companies in the market. You can request an offer from multiple cash companies and pick the one that suits you the best.

Is Opendoor Worth it?

Opendoor is a good option to offload your property stress-free. However, their lowball offers, high service fees, and repair costs may reduce your net proceeds.

Additionally, their final offer could be 2% to 3% lower than their original estimate. With little to no scope for negotiation, it is like a “take-it-or-leave-it-deal”.

The open market is a much better alternative to get your home’s worth. A Flat Fee MLS service like Houzeo can open doors to even a 100% FMV cash offer for your home. Houzeo lists your property on the MLS within 24 hours. They offer stellar tech with features to manage multiple cash offers and request the highest and the best offer.

» Houzeo Reviews: Here’s why 7,800+ home sellers have rated Houzeo 4.9 stars out of 5 on Google and Trustpilot.

📞 Need Help? Schedule a FREE Consultation

A Houzeo expert can answer all your questions regarding our technology.

Book a FREE Call

Frequently Asked Questions About Opendoor Reviews

How much does Opendoor charge?

Opendoor fees include a 5% service charge that sellers have to pay when they sell their homes. Opendoor also charges sellers repair and closing costs. To know about their fees click here.

Is Opendoor still buying houses?

Yes, Opendoor is still buying homes. As per their financial report, OpenDoor purchased a total of 2,680 homes from April to June 2023. This figure represents a 53% increase compared to the first quarter of 2023 but reflects an 81% decrease compared to the second quarter of 2022.

Does Opendoor pay closing costs for buyer?

No, Opendoor doesn't pay buyer closing costs. If you sell to Opendoor, you still have to pay 50% of the closing costs.

Who owns Opendoor?

Opendoor was founded in March 2014 by Keith Rabois and Eric Wu. Eric Wu serves as the President of Marketplace, and Carrie Wheeler is the Chief Executive Officer. To know more about the company click here.

What does Opendoor do with the homes they buy?

Opendoor purchases relatively good-condition houses for 70% to 80% of their fair market value. Later, they fix them up and sell them at a profit.

Reviews

(11 Reviews)

-

John

Verified Reviewer

All sounded good with initial offer. Then after they came to look at house. Lowered offer by 30,000.00 and said it needed over 30,000.00 work. House has new kitchen, new floors, new paint in and out and brand new A/C. They prey on people that are in a bad way (desperate). So wrong. Don’t know how they sleep at night

-

Sharon

Verified Reviewer

13th Oct 2023

As a real estate agent, I don’t like Opendoor. The listing agent is in another city and always difficult to reach. The offer process is ridiculous because you can’t reach anyone and/or know if the property is already under contract when you may be writing one. And in our market they ALWAYS replace the carpet with ugly brown carpet.

-

Jeff – Realtor

Verified Reviewer

13th Oct 2023

Opendoor has a nifty concept but is atrocious to deal with as a buyers agent. You can’t get a hold of anyone useful or knowledgeable about the local area. The process is stressful and properties overpriced.

-

Zorica

Verified Reviewer

13th Oct 2023

They gave my contact info to local real estate agency and their fee is 6% of sold price.

-

Mike Bennett

Verified Reviewer

13th Oct 2023

Terrible customer service. Paid 500.00 3 days ago and it’s still not listed. No one will answer a phone call

-

Tod G. Franklin, Real Estate Broker Dallas Texas

Verified Reviewer

13th Oct 2023

I call them Brokendoor because almost every time I show one of their homes the foundation rides like a roller coaster. Their business model attracts desperate sellers with some condition causing the home to not be retail saleable in MLS. Brokendoor gets these homes at a discount and does little to get them market ready. Its a perfume on a pig approach to flipping. Buyer beware I tell my customers when it comes to Brokendoor homes. They are more likely to paint a home than fix a foundation is what I usually see.

-

Karl Turner

Verified Reviewer

18th Oct 2023

Opendoor was not a pleasant experience but it may work for you.

-

Karl Turner

Verified Reviewer

18th Oct 2023

Did not like the experience at all.

-

Jeneane H.

Verified Reviewer

21st Oct 2023

This company wasted my time by giving me an initial offer, setting up a virtual walkthrough of my home, and then informing me a week later that they revoked the offer due to low resale numbers in my area. Not impressed!

-

Sterling Leavitt

Verified Reviewer

24th Oct 2023

While the concept is sound, they seem to be all over the place in my local market. I have not yet found a seller that was greatly joyful after their sale. Buyers tend to have low opinions of working with the purchase of an Opendoor property. As an agent, I do struggle often with being able to work with a person in a timely fashion and when we need to have a conversation about negotiations, this a an often painful process. I have attempted to work 8 clients through the process, none wanted to continue after the first failed contact

-

Unethical work dealings

Verified Reviewer

2nd Nov 2023

This company is the worst. They lowball offer you. The offered my clients an amount $40k below asking price. They told us we can sign up and just cancel anytime the due diligence period. We told them that we still want a higher payout on the home. So we relisted it for a lower amount but higher than what they were willing to pay. After 2 days of relisting it on a lower amount, we decided to accept their offer. They didn’t advise us not to change the price etc. 2 days after we accepted, they withdrew due to the changed price. What an awful company.

.webp)