The U.S. real estate housing market is expected to slow down in 2023 as a correction begins for the first time in over a decade. In 2023, housing experts predict an ongoing trend of mortgage rates stabilizing at about 6%, declining home sales, and median home prices plunging by 20% in some markets.

With the limited housing supply of 3.8 months and lower demand, real estate experts have mixed housing market predictions for 2023.

In this blog, we take a closer look at the housing market and share 13 predictions on what we can expect in the upcoming years.

Key Takeaways

- A surge in inventory and lower housing demand will likely lead to a buyer’s market in 2023.

- Mortgage rates dropped from 6.33% to 6.15% for the week ending on January 19, 2023.

- The Fed’s interest rate hike will cool inflation but cause prices to fall by 20% in some markets.

- The number of listings dropped by 22.4% in January as homeowners are reluctant to sell their homes.

- New home construction will continue to decline due to labor shortages, high materials costs, and an unstable market.

Housing Market Predictions 2023

Home sales are expected to reach their lowest level in more than a decade in 2023 due to high mortgage rates. Interest rates have exerted much-needed pressure on the housing market following record home prices nationwide. They are still hovering around double what they were a year ago.

New listings will also continue to decline yearly due to the “lock-in” effect of homeowners with ultra-low mortgage rates. The lack of inventory at 3.8 months’ supply keeps prices from dropping, making homes unaffordable for many.

Home prices remain high at a 1.2% YoY growth despite a decline in total sales of about -36.7% YoY. Economists are still determining whether home prices will decline through 2023 based on low housing supply.

1. 2023 will be a Buyer’s Market

Experts believe that housing market in 2023 will be buyer’s markets due to the drastic increase in inventory over the past few months.

Based on the number of active listings divided by the number of closed sales, the housing supply was just about 1.7 months back in May 2022.

Today, Redfin’s data tells us that the housing supply has increased to 3.8 months, up from 3.4 months a week earlier and up from 1.9 months a year ago.

Housing supply must be between four and six months to have a balanced real estate market. Traditionally, a buyer’s market is one with a housing supply of six months or more, but going from record lows of 1.7 months to more or less 3.8 months is very close to a buyer’s market.

2. Mortgage Rates will Stabilize at Around 6%

Redfin’s Deputy Chief Economist, Taylor Marr, believes the worst of inflation is behind us based on the latest CPI report. The Fed will likely continue easing its interest-rate increases, which should cause mortgage rates to continue declining.

A 30-year fixed-rate mortgage averaged 6.15% for the week ending on January 19, 2023, down from 6.33% the previous week. Even though mortgage rates increased at the end of December, they are still lower than last year’s peak of 7.08%.

According to George Ratiu, Realtor.com’s director of economic research, housing affordability will be the year’s top challenge as Fed tries to tighten the finances until inflation is moving toward 2%.

Mortgage Bankers Association (MBA) also predicted that Long-term rates have already peaked, and they expect that 30-year mortgage rates will end in 2023 at 5.2%. According to Freddie Mac , the average 30-year mortgage rate will start at 6.6% in Q1 2023 and end at 6.2% in Q4 2023.

3. Home Prices will Decline Up to 20% in Some Markets

By 2023, experts predict the median sale price growth to drop by roughly 4% to $368,000, the first annual drop since 2012.

Home prices were at a record high of 29% higher than their historical trend in June 2022. Primarily, due to low-interest rates and loose financial policies in response to post-pandemic housing boom. However, prices began declining rapidly in the last quarter of 2022 as the Fed hiked interest rates to cool inflation.

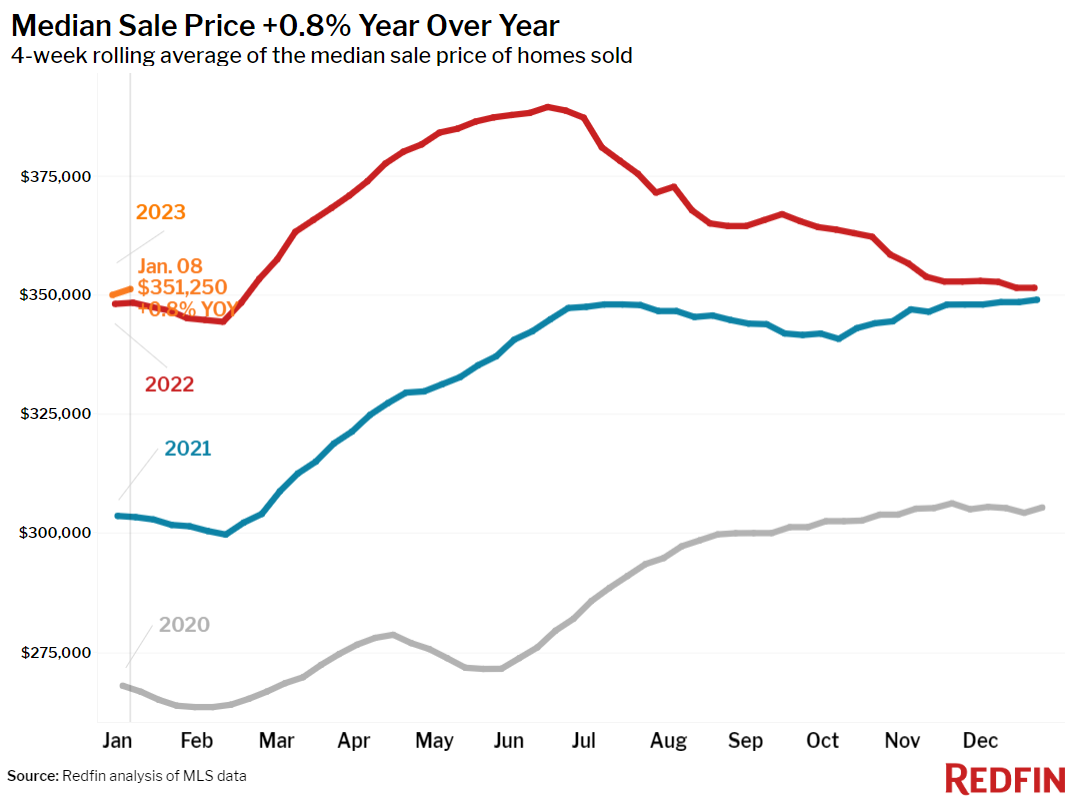

According to Redfin’s housing market update, a typical U.S. home sold for $351,250 during the four weeks ending on January 8. The median sale price is up 1.2% from a year ago but down about 10% from June’s peak.

According to DataTrek Research’s co-founder Nicholas Colas, US home prices need to fall by 15-20% over the coming years to return to their long-run growth trend.

20 of the 50 most populous U.S. metros saw home-sale prices fall year over year, which supports the above predictions. In contrast, prices declined in 11 metros. Also, 4% of homes for sale each week had their prices drop sharply from 5.7% in December 2022.

Here’s a chart by Redfin representing the huge decline in median sale price in the last two quarters of 2022 with the Y-o-Y growth rate.

Source: Redfin.com

4. Home Sales will Nose Dive

Home buying demand is decreasing big time!

Statistics indicate that 4.78 million existing homes will sell in 2023, 16% fewer than in 2022.

With increased interest rates and high home prices due to limited housing supply, housing affordability continue to challenge buyers. The number of mortgage applications rose 25% weekly but was 35% lower than one year ago as mortgage rates are about 2.6 percentage points higher YoY.

In the past four weeks ending on January 5, pending home sales have declined more than 30% for 11 consecutive months. There were also fewer new listings of homes for sale by 22.4% than a year ago, falling to a record low. Showingtime.com’s data also tells us that home showings across North America are down by -62.7 percent compared to the first week of 2022.

5. Housing Inventory will Continue to Remain Low

According to NAR’s 2023 housing market forecast, housing inventory is expected to remain tight in 2023. Housing inventory has been negatively affected by rising materials costs, supply chain issues, and labor shortages caused by COVID.

Traditionally, a balanced housing market requires about five to six months’ supply to avoid a buyer’s or seller’s market. According to Redfin’s data, it is at a 3.8 months supply.

Apart from that, the prevalence of institutional investors has impacted the supply by a significant extent. As per NAR’s 2022 report, institutional investors purchased 13.2 percent of all properties sold in 2021. New listings also fell by 22.4% in January. Homeowners who bought their homes at low mortgage rates are now reluctant to enter the market.

6. Housing Affordability will Remain Steady at Current Levels

Home affordability will likely be a top challenge in 2023 as Housing demand continues to outpace supply. According to NAR’s chief economist, rates will remain stable for existing homes during 2023, and approx 4.78 million existing homes will be sold.

Due to record-high mortgage rates and elevated home prices, the average mortgage payment on a median home after putting 10% down is $2,285, up by 58% YoY. Compared to January, when the cost consumed just 20.3% of a buyer’s income, it now consumes 30.2% of their income.

7. New Home Construction will Continue to Decline.

According to the data released by Census Bureau, new home construction dropped by 1.4% from November and was down 21.8% from a year ago. The number of new housing permits granted in December also fell, down 1.6% from November and 29.9% from a year ago.

Builders might continue to struggle with elevated construction costs, supply chain disruptions, and challenging affordability conditions.

Yet, Jerry Konter, NAHB chairman, believes the worst may be over for the housing market as home builders’ confidence rose for the first time in the past 12 months due to a modest drop in interest rates.

8. iBuyers are Likely to File Bankruptcy

-

👉 iBuyers: iBuyers are companies that make instant offers on homes using technology. You get 70% to 90% of the home’s fair market value.

» Opendoor Reviews: Read our reviews for the best iBuyer in the US.

The basic concept of iBuying is that they will offer you a slightly below the market value for your home. Furthermore, they can earn money by offering to finance or adding value to homes.

iBuyers may rent out their homes or fix them up and resell them. When the market is hot, this is a great way to make money, but when it is slow, they might have to book losses to loosen up inventory.

During the past year, house flipping profits have fallen by 18.4%. Top iBuyers like Opendoor face an existential crisis as iBuying fights for survival. The company recently reported a nearly billion-dollar loss as the cash-buying sector deals with a slowing market.

Additionally, Zillow and Redfin left this sector, and the remaining players reported huge losses last quarter.

9. Power Buyers will Also Go Out of Business

-

👉 Power Buyers: In a hot real estate market, power buyers level the playing field by leveraging their capital. They increase the purchasing power of homebuyers by providing services like cash offers, bridge financing, and trade-in programs.

Power buyers acquired a significant market share during the time of low-interest rates. Most of them sky-rocketed their sales from January 2021 to June 2022. However, as mortgage rates have risen and bidding wars have largely declined, the company’s products have lost appeal for buyers with inflated financing costs.

Ribbon laid off 136 employees in late July. Flyhomes laid off 200 workers in mid-July. Homeward reduced its staff by 20% in early August. Knock and Orchard have made substantial cuts.

Steve Murray, Founder of Realtrends, predicts that real estate power buyers must improve their brand recognition and expand their partnerships to sustain their business.

10. Cash Buyers will Remain Important

-

👉 Cash Home Buyers: “We buy houses for cash” companies are conventional, fast home buyers. They make instant cash offers and buy houses as-is, even extremely distressed properties.

» Companies That Buy Houses For Cash: Read our reviews for the best iBuyer in the US.

As mortgage rates remain high at 6%, home affordability is still a challenge for maximum homebuyers. Cash home buyers will remain important as they do not need a mortgage to purchase a home.

Also, desperate home sellers who need to sell their homes quickly will sell for cash.

Insurance premiums increased 33% year over year in 2022, and they’re expected to rise more in extremely climate-risky surroundings. Many areas at risk now require disaster insurance for mortgage approvals. As it becomes harder to find, affluent cash buyers will dominate those areas.

11. Cash will Still Be King

With interest rates at record highs, more sellers accept cash offers from investors than ever before. 31.9% of Americans sold their homes for cash in October 2022.

According to ATTOM’s newly released Q3 2022 U.S. Home Flipping Report, almost 7.5% of total home sales were flipped in the US. In particular, investors purchased 63.7% of homes flipped in the third quarter of 2022 with cash.

Cash will still be king if the buyers consider the right location, a realistic project, and an reasonable budget.

12. Real Estate Commissions will Decline

Joe Rath (Director of Industry Relations, Redfin) says commissions will likely decline once the market heats up.

Buyers’ agent commissions in the U.S. dropped to 2.63% of the home’s sale price in 2022, their lowest level since 2012. The downward trend in the buyer’s agent commissions will rebound or at least halt in the first half of 2023.

Home prices and sales decline will elevate buyers’ agent commissions next year. Sellers will also offer to pay higher commissions to attract bidders. Thousands of agents are expected to leave next year which will lead to an agent shortage. Agents will be able to charge higher commissions.

The industry is finding new ways to educate consumers on how agents are paid, including putting commissions on display. The DOJ (Department of Justice) is also investigating how agents earn and whether their commission structures limit competition.

The probe could result in buyers paying their agents, likely leading to a commission drop.

13. NAR will Remain Under Antitrust Scrutiny

The real estate industry ensures commissions are high by restricting MLS access, imposing minimum service laws, and charging sellers the buyer agent commission. But these practices are under strict scrutiny by the United States DOJ and the Federal Trade Commissions.

Several antitrust lawsuits have been filed against NAR lately. In March 2019, Christopher Moehrl sued NAR on behalf of himself and sellers, who had been paying a broker commission since March 6, 2015.

Joshua Sitzer and Amy Winger sued NAR, RE/MAX, Keller Williams, and HomeServices of America, including its subsidiaries BHH Affiliates and HSF Affiliates, in April 2019.

In May 2020, PLS.com filed its lawsuit seeking monetary damages and “injunctive relief.” The lawsuit claims that NAR eliminated the possibility of a more competitive market with the Clear Cooperation Policy (CCP), harming consumers and PLS’ business.

In May 2021, Rex sued Zillow, Trulia, and the National Association of Realtors for segregating listings to hinder competitors who don’t want buyer agents.

According to these lawsuits, buyers’ agents show clients listings to people who pay high commissions. The lawsuits also allege that the plan forces home sellers to pay a cost the buyer would pay in a competitive market.

When will the Housing Market Crash?

Economists believe the housing market will slow down but not crash.

The Fed will play an important role in the housing market’s future as it tries to lower inflation by increasing mortgage rates.

Let’s look at why most experts believe that the housing market is not going to crash.

5 Reasons Why the Housing Market is Unlikely to Crash

1. Low Inventory

As per January 2023 data, only a 3.8-month supply is available. This scarcity of inventory explains why many buyers need to bid over the listing price. Also, the supply-demand curve indicates that prices won’t crash shortly.

2. Lack of Newly Constructed Housing Supply

The supply of newly constructed houses has yet to return to pre-2007 levels. Also, there’s no way for the homebuyers buy land, get regulatory approval, and increase the supply quickly.

3. Several New Buyers

There’s a strong demand for homes across various demographics. Millennials and Hispanics are in their prime buying years. As a result, there’s still a limited amount of inventory available.

4. Strict Lending Standards

There were several cases of liar loans in 2007 where anyone could get a mortgage without a credit check. Today, lenders place high standards on borrowers, and most home buyers have excellent credit scores.

» Mortgage Lenders: Real estate market impacts mortgage rates and vice versa. Learn how lenders deal with it.

5. Drop in Foreclosures

A majority of homeowners own significant equity in their homes. The personal balance sheets of homeowners are much stronger today than they were 15 years ago. As a result, there is no threat of a foreclosure crisis.

» How to Stop Foreclosures: Foreclosure in any aspect is a negative situation. Learn about it so that you are aware.

Will Home Prices Drop in 2023?

In 2023, experts predict a 4% drop in the median sale price to $368,000, the first annual decline since 2012. The housing market continues to slow down between high mortgage rates and economic uncertainty.

As per Zillow’s forecast, the national Zillow home value index is expected to rise by only 1.3% in the following year. Last year, it was 12.9%.

Another reason that may support the forecast is lower home sales. NAR predicts that there will be 4.78 million existing home sales in 2022.

Also, a recent decline in mortgage applications by 41% and pending home sales data suggest a lower sales volume in 2023.

Current Housing Market Trends

Will 2023 be a Buyer’s Market or a Seller’s Market?

Going from record lows of 1.7 months to more or less 3.8 months is very close to a buyer’s market.

Additionally, FloridaRealtors.org predicts 36 markets will be buyers’ markets by November 2023, 41 markets will be sellers’ markets, and 23 will be neutral markets.

As the market continues to cool, the 100 largest markets are projected to see home sales decline by 16% YoY.

Tips for Selling a Home Now

21% of homeowners still believe that now is a good time to sell a home, if you are in a market where home prices are still high.

1. Price Your Home Competitively

In a soft real estate market, inventory is usually high, and home prices keep decreasing due to lower demand. It is better to price your home competitively and get the best deal.

Research comparable house sales in the area and price your home accordingly.

Redfin’s data tells us that a typical home sells for less than the asking price. Pricing your home too high may discourage potential buyers.

2. Offer Incentives

Selling a house is not an easy task in a slow real estate market. You must make the deal look more attractive to sell your house.

Offer to cover closing costs, accept inspections, or provide a transferable home warranty as incentives.

» Closing Costs for Buyer: Find the respective closing costs obligations for buyers in your state.

3. Find a Way to Get the Best Offer

The first and foremost step is to find a medium to sell your house for top dollar. List your property on MLS for the best results.

We do not recommend listing with full-service real estate agents as they charge hefty commissions.

Realtors provide access to the MLS, but you can skip this and list on MLS via the Flat Fee MLS listing service.

» Houzeo Reviews: Get maximum exposure for your home by listing it on the MLS.

Tips for Buying a Home Now

Buying a home is a personal decision. If you are in a stable financial position you can plan to buy a house. Make sure you have 5 to 6 months of savings after you put your down payment.

» How to Buy a House: Since interest rates are high and supply is limited, you should know when to start house hunting.

1. Don’t Buy at the Lowest Price

The housing market starts to slow when the properties’ supply exceeds the present demand.

As a result, sellers have to lower the prices of their homes. However, you shouldn’t buy a home just because it’s the cheapest.

Sellers can conceal the need for major repairs, which could result in a major expense for the buyer. A home inspector can help the buyer inspect the property thoroughly.

» Home Inspectors: Check out the best home inspectors available in your area.

2. Consider the Value of the Property

A slow market is the buyer’s market.

There is a high chance that the home values may decrease before it starts to increase again.

3. Do Not Invest in the Properties For the Short Run

If you’re not planning to stay in a real estate property for a long time, do not buy it.

Buying a home solely for selling will only increase inventory. This won’t be beneficial in a slow real estate market.

» Best Time to Buy a House: Know exactly when it is best to buy a house!

Top 5 Metros Where Prices Will Decline Most by Late 2023

According to Zillow real estate market predictions, home values will decline in 314 regional housing markets between October 2022 and October 2023. With an anticipated decline of 6.7%, Great Bend, KS, tops the list.

| 🏠 Area | 🔴 Decline in Value |

| Great Bend, KS | -6.7% |

| Clinton, IA | -6.1% |

| Minot, ND | -6.0% |

| Helena, AR | -5.4% |

| Fairbanks, AK | -5.3% |

Top 5 Metros Where Prices Will Rise Most by Late 2023

Even after huge declines in median sale prices, Zillow expects that home values will continue to rise in most regional housing markets by 2023. Top of the list is Texas (Pecos), with a 10.5% projected increase.

| 🏠 Area | 🟢 Rise in Value |

| Pecos, TX | +10.5% |

| Aberdeen, WA | +8.4% |

| Jackson, WY | +8.4% |

| Coeur d’Alene, ID | +7.7% |

| Lake City, FL | +7.2% |

Housing Market Predictions for the Next 5 Years

The housing market is under close observation by experts. Home prices have risen by 57.65 in the past 5 years. The growth is expected to decline significantly.

As mortgage rates continue to remain high, homebuyers will delay their purchase. There will be lesser demand for housing, and the home value growth rate will decrease.

Disclaimer: The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Houzeo Corp., its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any investment decision and it has been provided to you solely for informational purposes only and does not constitute an offer or solicitation of an offer, or any advice or recommendation.

Frequently Asked Questions

1. When is the housing market predicted to crash?

Economists do not believe that the real estate housing market will crash.

According to housing economists, there are five significant reasons why the market will not crash anytime soon: Low inventory, Lack of newly constructed housing supply, Several new buyers, Strict lending standards, and a Drop in foreclosures.

2. What are the real estate housing market predictions for 2023?

The U.S. Housing market is expected to slow down in 2023 as a correction begins for the first time in over a decade.

In 2023, housing experts predict an ongoing trend of stabilizing mortgage rates near about 6%, declining home sales, and plunging median home prices by 20% in some markets.

3. What are the housing market predictions for next 5 years?

As mortgage rates continue to remain high, homebuyers will delay their purchase. There will be lesser demand for housing, and the home value growth rate will decrease.

.webp)