The average real estate commission in North Carolina can hit up to 6% in 2025, of which you pay 3% to the listing agent. That’s $11,472 for a $382,400 home, just to get it on the MLS. Skip it! With Houzeo, North Carolina’s best real estate platform, you can get MLS exposure for just $249.

But wait – you can save even more! Post NAR Settlement, the buyer’s agent fee is negotiable. This means you could pay even $0 to the buyer’s agent, saving around $22,944. That goes a long way in the Old North State, where every dollar counts!

KEY TAKEAWAYS:

- Post-NAR Power Shift: The buyer’s agent commission is now in the hands of the seller. You can pay zero, negotiate, or offer it as a concession – the choice is yours.💪

- Negotiate Each Dollar: Never assume that the real estate commission in North Carolina is fixed! Your negotiating power impacts your profit.💲

- Master Your Sale: Research the market, find local median home prices,and set the perfect asking price for a quick home sale.💡

- Save With North Carolina Flat Fee MLS Service: Your home gets listed on the MLS for a flat fee- that’s a fraction of the cost you’d pay to the Realtor.⚖️

What Is the Real Estate Commission in North Carolina?

It is a percentage of your home’s sale price that you pay as a Realtor’s fee. The average real estate commission rates can range between 5.5% to 6%, and are negotiable.

The typical real estate commission in North Carolina is split between the listing agent and the buyer’s agent. You pay around 2.5% to 3% to both agents. On a $382,400 median home, that’s$22,944 -enough to invest in solar panels and attic insulation.

The average Realtor commission can go up to 6% of the sale price in North Carolina. While sellers traditionally paid both agents, they’re no longer required to cover the buyer’s agent commission post the NAR Settlement.

What Impacts Your North Carolina Realtor Fees?

The North Carolina real estate commission isn’t set in stone! Here are some of the factors that influence the Realtor’s fee:

- Property Type: Single-family homes typically align with the state average rates. Luxury properties might see lower percentages (4%-5%) due to their high sale price. Conversely, vacant land or commercial properties command more commission due to longer sales cycles.

- Market Conditions: In a seller’s market (low inventory), agents might be more flexible as homes sell faster. However, in a buyer’s market (high inventory), agents seek higher rates due to increased marketing needs.

- Agent Experience and Services: Experienced agents often ask full fees for their expertise and services they offer, such as professional photography, marketing, negotiation, etc. Less experienced agents or those offering limited services might be more negotiable.

What Are the Regional Real Estate Commissions in North Carolina?

North Carolina Realtor fees aren’t one-size-fits-all! Location matters, and you can expect regional variations. Less competitive markets like Fayetteville, Rocky Mount, or Goldsboro can see lower rates.

However, cities with tourism and luxury homes like Asheville, Wilmington, Raleigh, and other upscale areas can see higher rates. This is due to their scenic locations, limited land, strong demand, and the high-end mountain lifestyles.

| 1. Asheville, NC | Real Estate Commission in Asheville |

Who Pays the Realtor Fees in North Carolina?

As per the new real estate commission laws, it depends on how you negotiate. Here’s how the North Carolina real estate agent fees are compensated now:

1. Listing Agent Fees: Who Pays?

If you’re a home seller, you pay the listing agent commission. It’s generally 3% of your home’s selling price and is included in the closing costs for sellers. Your listing agent and broker further divide this commission between them.

Traditionally, the seller would pay for both the listing agent and the buyer’s agent. But after the NAR Settlement, the seller pays for the listing agent to list on the MLS and is no longer obligated to pay for the buyer’s agent.

2. Buyer Agent Commission: Who Covers the Cost?

Buyer’s agent fee is now primarily the buyer’s responsibility after the NAR Settlement. However, here are 3 ways it can be compensated:

- Seller Covers the Buyer’s Agent Commission: You can still choose to pay the buyer’s agent. However, the fees are no longer advertised on the MLS. This requires your agent or you to contact the buyer’s agent outside the MLS to discuss the commission.

- Buyers Pay Their Agents: The buyer can choose to (or you can ask them to) compensate their agent. Buyers’ agents typically require their clients to sign an agreement. It clearly states the commission amount that the buyer has to pay.

- Sellers and Buyers Negotiate a Deal: In a buyer’s market, buyers can bid higher and request you to offer a concession. The concession goes to the buyer, who can use it to cover costs like the agent fees.

Does the NAR Settlement Benefit Home Sellers?

The NAR Settlement favors sellers in 3 ways:

1. You Get More Control Over Costs

You now have the power to decide if and how much you contribute to the buyer’s agent. This means you can offer nothing or negotiate a specific amount as a seller concession.

2. You Enjoy Clearer Deal Terms

The buyer agents now sign written agreements with their clients for their services and fees. This means you can’t be scammed with hidden costs. All the parties know the costs upfront, leading to a smoother home sale. Remember: if it’s not in writing, it’s not happening!

3. You Attract More Serious Buyers

With direct client agreements, buyer agents would bring only committed buyers for your property. This filters out casual shoppers, ensuring more qualified offers for you!

How to Save on North Carolina Real Estate Commissions?

The 3% listing agent commission can amount to a whopping $11,472 in North Carolina. When you minimize these costs, you maximize net profit! Here are some ways to save big on your home sale:

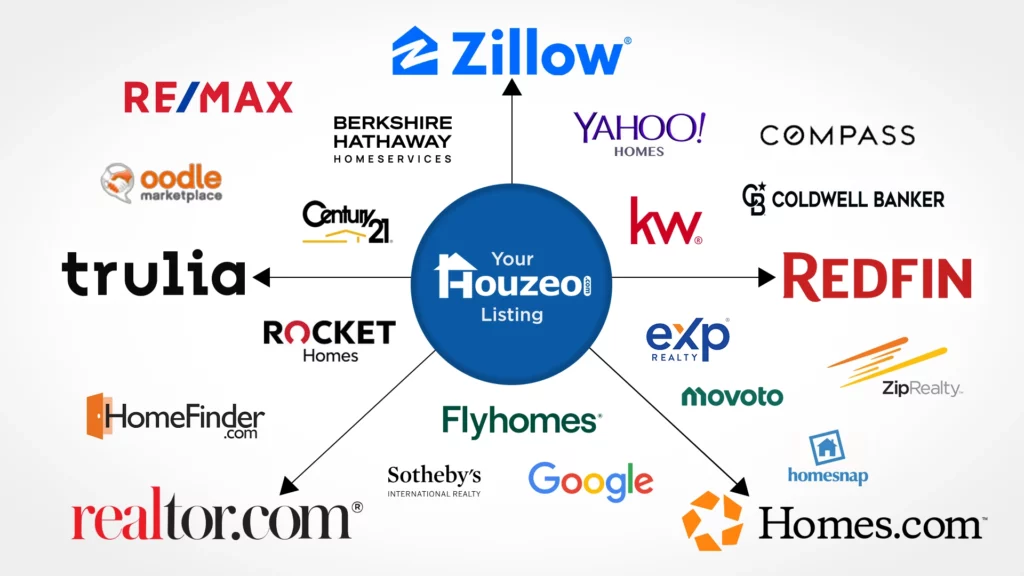

1. List for a Flat Fee

If you want max exposure without high commissions, but are unsure how to list on the MLS in North Carolina, Houzeo is your answer. Your home gets listed within 24 hours, at a fraction of a Realtor’s cost. It’s the I-40 fast lane through Raleigh — smooth and direct.

Thousands, depending on your home value! Calculate your home savings in North Carolina now.

2. Sell ‘FSBO’

FSBO means selling your home without a Realtor in North Carolina. You’ve got to market your home, manage showings, and handle negotiations, all by yourself. It’s like winding through the Blue Ridge Parkway in the fog without GPS!

And, here’s your GPS with detailed directions- with the best For Sale By Owner websites in North Carolina, you get licensed broker assistance to help you sell like a pro!

FSBO Home Sale in North Carolina: The Blueprint 📜

If you want to sell without a Realtor, you don’t have to feel overwhelmed! This free FSBO checklist is a step-by-step guide for a smooth, commission-free sale.

Keep the Commission, Take the Checklist

Smart sellers use checklists. Savvy sellers use ours.

Download Your FSBO Checklist3. Choose a Discount Real Estate Broker

It’s possible to get access to the MLS with negotiation support but without the 6% commission. North Carolina’s discount real estate brokers are a good option to consider. They offer traditional Realtor services but at discount rates (typically 1% to 2%). It’s the best of both worlds: full-service support without the full-service fee!

👉 List Your Home Now and Save Thousands on Commissions

4. Sell to an iBuyer or Cash Buyer

If you want to sell your home fast for cash, a cash buyer marketplace might be what you need. You get quick, competitive offers, as multiple bids can get you 100% of your property value. Think of it like skipping the line at Lexington BBQ on a Saturday — everybody wants it!

What Should You Do Before Paying a Realtor Commission?

To sell your home like a pro, you must master commission negotiation and know what you’re paying for! Use these tips to outsmart common mistakes and avoid slipping into the same red clay as the last seller in the Piedmont.

- Negotiate Your Fee: Don’t assume the 5% to 6% commission is final. You can negotiate for a lower commission rate.

- Look Beyond the Commission Rate: Paying a hefty fee doesn’t always mean that you’ll get the best service. You might need to market your property well to make your home sell faster in the current North Carolina housing market.

- Evaluate the Services Included: Some agents might offer fewer services for the same standard commission. Finalize your commission rate after you clarify what their package includes (e.g., home staging, photography, marketing).

- Widen Your Buyer Pool: Depending on the number of North Carolina property listings and market trends, you might have to offer to cover a part of the buyer’s agent fee. This can help you attract a lot of buyers who would need financial assistance for their agent.

How to Avoid High Realtor Fees?

Houzeo is the answer for you! Houzeo is North Carolina’s best home buying and selling platform. For sellers, Houzeo offers Flat Fee MLS North Carolina packages that save you thousands in commissions. Here’s how you can slash commissions and maximize your profit:

- #1: Visit Houzeo.com: This is your first step towards taking control of your sale and saving thousands in commissions.

- #2: Create Your Account and Start Listing: Set up your profile in minutes, then click “Sell Your Property” on your dashboard to begin your North Carolina house sale journey.

- #3: Enter Property Details: Fill in all crucial details – beds, baths, square footage, etc. Also, strategically price your home for sale to attract North Carolina buyers.

- #4: Choose Your Flat Fee MLS Plan: Pick the plan that aligns with your needs while selling a house in North Carolina. Each option comes with tailored features, comprehensive services, and commission savings.

- #5: Upload Pictures and Sign Agreement: Add your best shots and digitally sign your listing agreement to get your home live on the MLS fast!

How Much Do You Save With Houzeo?

Almost $18,000!

When you sell your house with a listing agent, you may have to spend a whopping $22,944, on a median home of $382,400 in North Carolina. However, with Houzeo, you get to save a huge $18,821!That’s your ticket to a family weekend in the Outer Banks or stormproofing your home before hurricane season.

| Service Provider | Fee in North Carolina | Savings |

| Real Estate Agent | 3% Listing Fee + 3% Buyer’s Agent Commission: $22,944 | $0 |

| Houzeo | Fixed Fee: $299 + $3,824= $4,123 | $18,821 |

Why Pay More When You Don’t Have To?

Houzeo cuts the 3% listing agent fee, helping you keep thousands in your pocket. The Houzeo Mobile App is super easy to use and makes selling your house a cakewalk. Sell smarter with Houzeo, North Carolina’s highest-rated platform for a truly stellar sale!

» Houzeo Reviews: Find out what customers are saying about Houzeo – North Carolina’s best home buying and selling website.