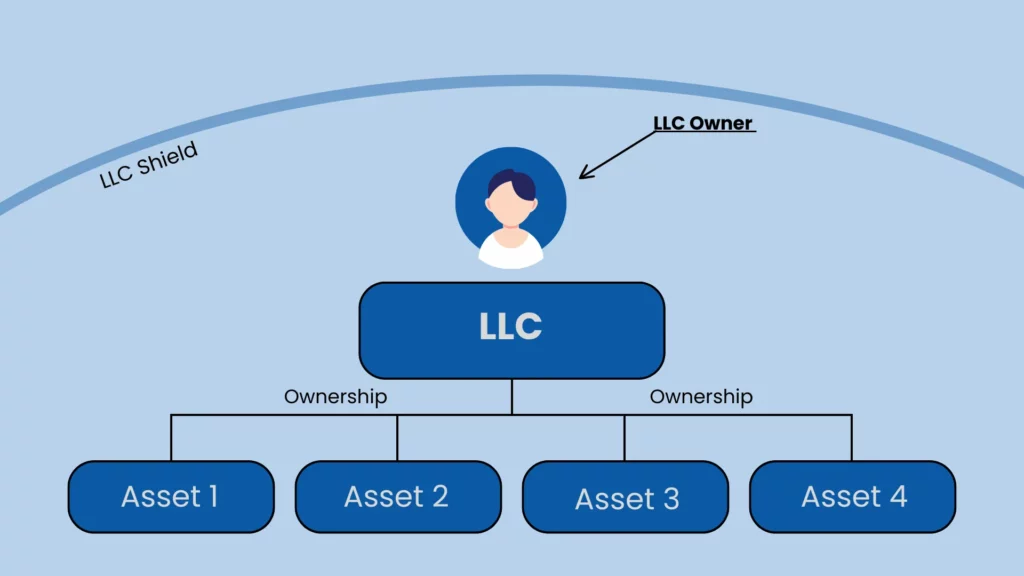

Many buyers explore purchasing a house through a Limited Liability Company (LLC) to protect their personal assets and maintain privacy. This structure offers a layer of liability protection, shielding personal finances from potential lawsuits or other financial risks—one of the main reasons real estate investors prefer it.

However, buying through an LLC comes with real challenges. Financing is often harder, lenders impose stricter requirements, and transfer taxes may apply. For most first-time homebuyers, this approach is not recommended, as it can lead to higher costs and potential losses over time.

In this guide, we’ll walk you through the step-by-step process of buying a house with an LLC in 2025, including costs, tax implications, and key considerations.

Key Takeaways:

- Liability Protection: Buying through an LLC shields your personal assets from lawsuits or debts tied to the property.

- Privacy Advantage: Purchasing through an LLC keeps your name off public property records, offering greater privacy and discretion in ownership.

- Financing Challenges: Getting a mortgage is harder. Lenders often require larger down payments, higher interest rates, and personal guarantees.

- Costs and Tax Implications: LLC setup fees, annual maintenance costs, and loss of primary home tax benefits can reduce profits.

- Best for Investors: This approach suits real estate investors or landlords more than first-time buyers due to its complexity and costs.

Can You Buy a House With an LLC?

Yes, you can technically buy a house under an LLC, but it involves many steps and considerations. When you are buying a house with an LLC, the LLC becomes the legal owner on paper. Because of this, banks don’t show much trust in homebuyers with LLCs.

To tackle this, you can buy the property in your personal name using a mortgage and transfer it to your LLC after closing. Before doing so, talk to your lender to make sure the transfer won’t trigger the due-on-sale clause. In this setup, you’ll remain responsible for the loan, while the LLC legally owns the property.

If the LLC owner has multiple properties under the LLC and, for instance, the owner’s personal assets are at risk, the assets under the LLC will be safeguarded.

Steps for Buying a House Under an LLC

The process of buying a house with an LLC is different from buying one in your name. Here are the steps to buying a house:

- Form the LLC: You’ll need to create an LLC in your state. It is an easy process that costs about $50-$500, depending on your state. You’ll choose a business name and obtain an Employer Identification Number (EIN), which acts as a Social Security number for your business.

- Open a business bank account: Opening a new business bank account is crucial to maintain the liability protections. This account would hold all property-related finances, separate from your personal accounts.

- Secure a mortgage: With an LLC, you cannot avail traditional mortgages like FHA. But you have many financing alternatives. Most lenders will require personal guarantees from LLC members.

- Purchase a house: Once you’ve secured financing in the LLC name, you’ll close the house as the LLC representative. The title company will record the LLC as the property owner.

- Get appropriate insurance: A standard homeowners insurance is not applicable for an LLC home. Here are some common types of insurances for LLC homes:

- A specialized homeowners insurance would treat the LLC as the “named insurance” and not an individual.

- An Umbrella Liability Insurance brings in additional protection. It covers the costs of protracted legal battles or large damages.

- If you want to rent out your LLC homes, then you need a landlord insurance, aka rental property insurance.

Pros and Cons of Buying a House Under an LLC

Here are the pros and cons of buying a house through an LLC:

| Pros | Cons |

| Asset Protection and Separation: LLC shields personal assets from lawsuits and debts. It also keeps personal and business finances separate. | Loss of Capital Tax Exemption: With an LLC you pay the capital gains tax on 100% of the profit of your primary residence. |

| Tax Benefits: With LLC’s pass-through structure, you remove the possibility of double taxation. The buyer pays their share, and the LLC pays the taxes on the profit. | Maintenance Costs: Setting up an LLC and maintaining it costs you extra. On average, LLC owners pay $1,000 annually in fees. |

| Privacy: With LLC name on public documents, you get added privacy. | Limited Financing Options: To buy a house with an LLC, you cannot apply for multiple loans like Fannie Mae, Freddie Mac, FHA loans. |

Buying a House After Bankruptcy: What You Need to Know

You might be wondering if buying a house after bankruptcy is possible. The answer is yes — you can buy a house after declaring bankruptcy. The process depends on the type of bankruptcy you filed. There two types: Chapter 7 and Chapter 13.

Under Chapter 7 bankruptcy, you can clear unsecured debts like credit card bills, but assets beyond the exempt limit may be sold. You can usually buy a house 2–4 years after filing. FHA and VA loans require a 2-year wait, USDA loans need 3 years, and conventional loans require 4 years.

Chapter 13 bankruptcy lets you to reorganize your debt and pay it back over 3-5 years. After a Chapter 13, you can buy a house in as little as 0-2 years. There is no waiting period for FHA and VA loans and 1 year for USDA loans. For a conventional loan, there is a waiting period of 4 years — just like with Chapter 7.

Who Should Consider Using an LLC to Buy a House?

Buying a house with an LLC is usually better suited for experienced real estate investors. It can also be useful for owners planning to rent out their property. That said, for first-time homebuyers, the drawbacks often outweigh the benefits — higher fees, extra paperwork, and possible after-sales tax issues linked to tax exemptions.

Financing an LLC Purchase

LLC reflects a risky investment for lenders, so you may face difficulty financing it. But there are some loan programs that ask for a lower down payment.

Here are some of the LLC financing options:

- Traditional Mortgages: The LLC owner may have to personally guarantee the loan. If they do so, they may get the loan at lower interest rates.

- DSCR (Debt Service Coverage Ratio): Uses property income rather than personal earnings to determine your ability to repay.

- Asset-based Lenders: Lenders will base their loans on existing assets than a cash flow

- Commercial Real Estate Loans: These loans requires you to provide a 20-30% downpayment.

Bottom Line

Buying a house with an LLC has its advantages, but for first-time buyers, the drawbacks usually outweigh the benefits. If you plan to make a career in real estate, an LLC can be a viable option for risk-free transactions.

Keeping up with the U.S. real estate market reports will also help you make informed decisions on pricing trends and potential returns on investment.

If you’re ready to buy a house, explore thousands of homes for sale on Houzeo, America’s top home-buying website.

» Need More Clarity? Read these exclusive Houzeo reviews and learn why the platform is the best in America’s competitive housing market.

Frequently Asked Questions

Can I use my LLC to buy a house?

Yes, you can buy a house through your LLC. It helps separate your personal and business assets, but keep in mind that getting financing may be more difficult.

Can an LLC get a mortgage?

Yes, an LLC can get a mortgage, but the process is more complex. Lenders may require higher interest rates, larger down payments, and personal guarantees from LLC members.

What are the pros and cons of buying a house with an LLC?

The pros and cons of buying a house with an LLC include more privacy and protection, but also stricter loan terms and higher costs.

What is the process of buying a house with an LLC?

To buy a house under an LLC, you'll need to form an LLC, secure financing, and then proceed with the purchase process. It's advisable to consult with a real estate attorney familiar with LLC purchases.