Home sellers in Kentucky spent an average of 9 to 15 months selling their inherited property.

Analyzing the current Kentucky real estate market, the average time to sell a house in Kentucky is 83 days. Factors like house location, home size, condition, etc. can increase your home’s days on the market.

For an inherited house, the probate process is necessary to legally transfer the property. It typically takes up to 11 months but can be delayed by multiple heirs and disagreements.

To Sell My Inherited House

- How Long Does It Take to Sell? It takes an average time of 9 to 15 months to sell an inherited property, depending on the probate process.

- Taxes to Sell an Inherited Property: You need to pay transfer tax, property tax, and capital gains tax to sell an inherited property.

- Fastest Way to Sell: Selling to a cash buyer is the fastest way to sell your inherited property as is.

Can I Sell an Inherited House in Kentucky?

Yes, you can sell your inherited house in Kentucky. Your property must undergo a probate process before you sell it.

What Is a Probate Process?

A probate is a legal validation of a deceased person’s will. Probate helps to distribute the property amongst its heirs and beneficiaries.

You need to submit the owner’s death certificate and proof of ownership during the probate process. After the completion of probate, you have to pay for several expenses such as outstanding mortgages, taxes on the property, and other bills.

An ‘Alienation Clause’ triggers when the ownership of a mortgaged property is transferred to an inheritor. So the inheritor has to pay off the full mortgage.

Almost every inherited property in Kentucky must undergo a probate process. This can take up to 11 months. However, this period varies state-wise and depends on the number of inheritors and state laws.

Properties Exempted from Undergoing Probate Process

Your property will exempt a probate under the following conditions:

- Right of Survivorship: You can own a property in joint ownership with a “right of survivorship” clause in it.

- Receive a House in Trust in Kentucky: As a legal heir, you can inherit a house directly without probate if the owner has placed the home in trust.

How to Sell an Inherited House in Kentucky?

Selling an inherited house is similar to selling any other property. The best option to sell your house for the most profit is either sell it through a real estate agent or sell it yourself.

1. Hire a Local Real Estate Agent

Real estate agents are well-versed in the market conditions. They market your property to buyers via MLS or other real estate networks to get you the most possible money for your property.

Moreover, agents can also advise you after you start receiving offers. But, agents do charge hefty commissions from 5% to 6%.

2. Sell For Sale By Owner (FSBO)

You can save on hefty commissions by listing your house for sale by owner. But when selling FSBO, you need to handle the paperwork and closing yourself.

You have full control over your transaction to engage with the buyer and buyer’s agent. Moreover, KY For Sale By Owner sites help you get listed faster, typically within 24 to 48 hours.

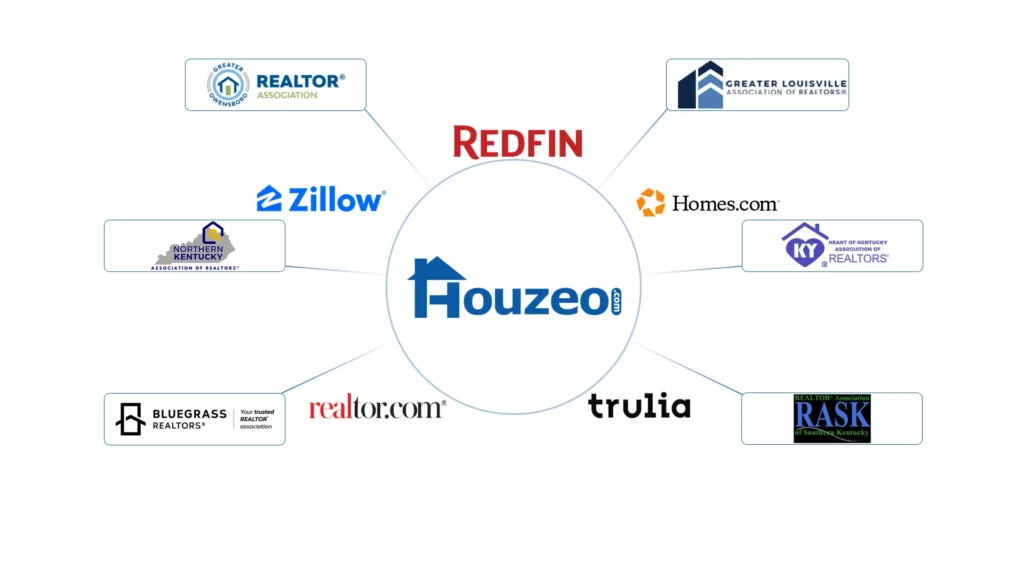

Flat Fee MLS companies like Houzeo offer advanced technology to streamline your listing process. Houzeo’s mobile app helps you manage offers and showings at your fingertips.

Alternate Ways to Sell Your Inherited House in Kentucky

You have other alternatives to sell your inherited home:

- List with a Discount Real Estate Broker: Kentucky Discount real estate brokers offer all the services that traditional Realtors do but at discounted rates. You can also opt for a flat rate Realtor to list your home.

- Sell Your Home to an iBuyer: An iBuyer can instantly make a cash offer and help you sell your house quickly. They make offers close to fair market value. However, iBuyers have strict purchase criteria.

- Sell Your House to Cash Buyers: Kentucky cash companies can help you sell faster if you have a distressed property. However, cash home buyers typically offer 50% to 70% of the property’s fair market value.

- Sell Your House to a Flipper: You can sell your inherited property to professional house flippers in Kentucky. They offer up to 70% of the fair market value.

Taxes on Selling an Inherited Property in Kentucky

You have to pay the following taxes while selling an inherited property in the Bluegrass State.

- Transfer Tax: Transfer tax is a one-time fee (generally costs less than 1%) that the inheritor pays at the time of transferring the ownership. This tax is paid to the local government.

- Property Tax: The average property tax in Kentucky is 0.80% of the total sale price of the property.

- Capital Gains Tax: The IRS (Internal Revenue Service) authority levies the capital gains tax on a stepped-up basis. So, this tax would only apply to the property’s appreciation after it was inherited.

» Capital Gains Exemptions: Know how you can exempt capital gains tax.

Selling a House in Kentucky with Multiple Inheritors

Multiple inheritors can be close family members like siblings, cousins, or anyone the deceased person chooses. So, selling a house in Kentucky with multiple inheritors is a real curve ball.

In such cases, the first step is to come to an agreement on selling or buying the property with the other inheritors. You can appoint a neutral party (non-beneficiary) as the head person for the sale.

The neutral party will ensure a transparent home sale process. They will ensure a fair distribution of proceeds amongst the inheritors.

What if All Inheritors Don’t Agree to Sell?

If all inheritors do not agree then the property cannot be sold. Chill! If the majority of the inheritors are willing to sell the property they need to go through a probate court.

The inheritors can file a ‘partition action’ lawsuit in the probate court. In such cases, the court enforces the sale. As a result, the inheritors have to divide the proceeds among themselves as per the will.

Let’s Sell Your Inherited House

Selling your inherited house in Kentucky is a complex and time-consuming process. Your inherited home might remain in probate for up to 11 months. You also have to pay several taxes while selling your inherited home.

To get the best price for your property, we recommend you list your home on Kentucky MLS. However, this provides exposure to your property to buyers and real estate agents.

With a KY Flat Fee MLS company like Houzeo, you can list your property on the MLS right after the probate. An MLS listing via Houzeo will give your house maximum exposure, and you may even attract cash offers.

| Louisville, KY | Selling an Inherited Property in Louisville, KY |

» Selling an Inherited Property with a Mortgage: Learn what to consider and what not when selling an inherited property with a mortgage.

Eager to Know More About Houzeo?

We’ve got you covered. Check out the following video to understand why Houzeo is one of the best for sale by owner websites in the U.S.

» NEED MORE CLARITY? Watch exclusive Houzeo reviews and learn why it is one of the best FSBO sites in America.

Frequently Asked Questions

Do beneficiaries have to pay taxes on inheritance in Kentucky?

Beneficiaries may or may not be subjected to inheritance taxes depending upon the class they are placed in. These classes are pre-defined by the state government based on the beneficiary's relationship with the decedent.

Is there a time limit on selling inherited property in Kentucky?

No, there is no time limit to sell an inherited property in Kentucky. Once the probate process is completed and the legal inheritor is declared, you can sell your inherited property anytime.

How to pay-off the mortgage on inherited property in Kentucky?

You can pay the mortgage on an inherited asset in multiple ways:

1. You can sell the property and pay-off the debt.

2. Transfer the mortgage along with the ownership of the house in your name.

3. The Kentucky mortgage lender can foreclose the property if no inheritor pays the debt.

Related:

inheritance tax kentucky, transfer on death deed kentucky, kentucky estate tax, kentucky capital gains tax, kentucky probate law, kentucky inheritance tax, transfer of property after death without will in kentucky, kentucky inheritance law, does kentucky have an inheritance tax, inheritance tax in kentucky, kentucky estate laws, kentucky property laws, kentucky intestacy laws, kentucky probate, laws, kentucky inheritance laws without a will,

kentucky inheritance laws, heir property laws in, kentucky, kentucky capital gains tax on real estate, does kentucky have inheritance tax, estate taxes, in kentucky, estate tax kentucky, kentucky escheatment, death tax in kentucky, kentucky, intestate succession, how to probate an estate without a will in kentucky, kentucky estate law, is, there an inheritance tax in kentucky, estate tax in kentucky

Kentucky Selling Inherited Property

.webp)